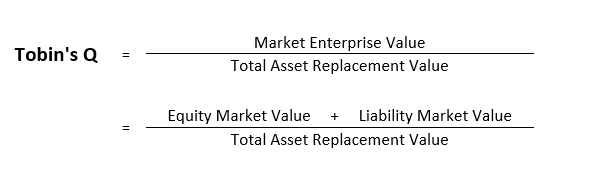

Tobins Q Formula

The other the denominator is th.

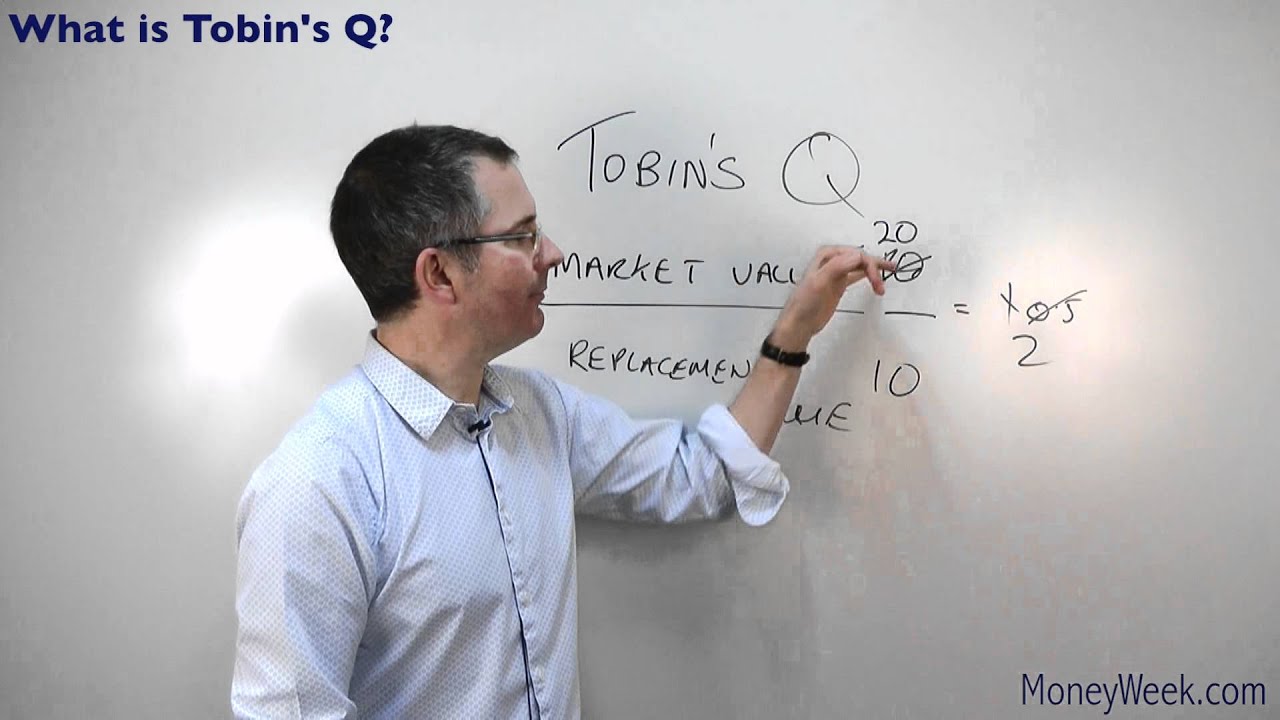

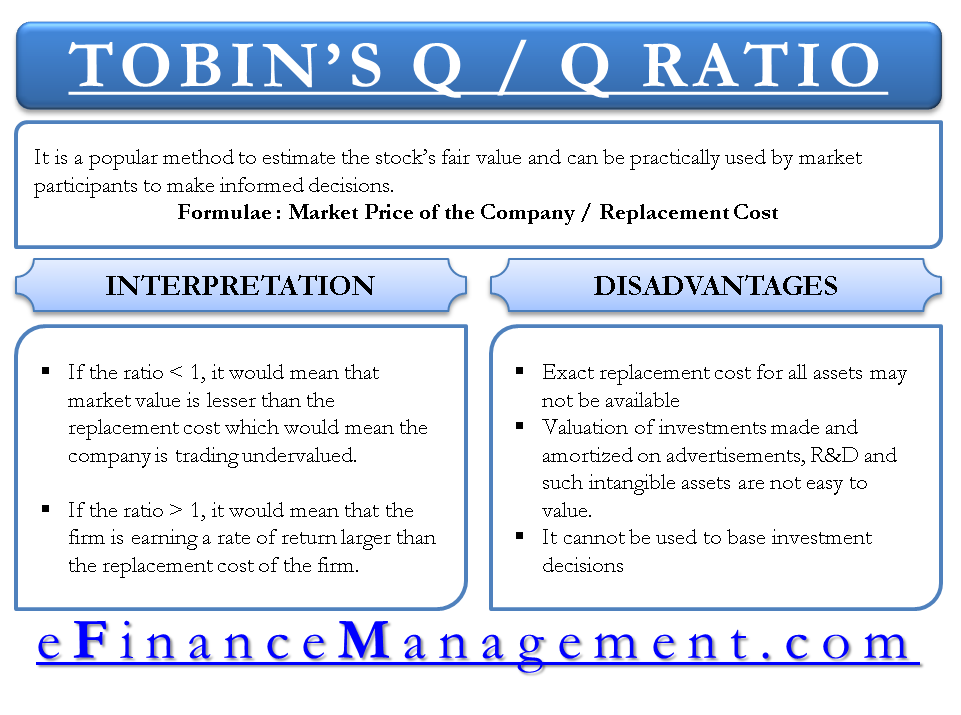

Tobins q formula. Formula of the q ratio. The q ratio is a popular method of estimating the fair value of the stock market developed by nobel laureate james tobin. Tobins q 10000000 x 3 40000000 075 james tobin a nobel prize winner in economics and a professor at yale university developed the ratio after hypothesizing that companies should be worth what they cost to replace.

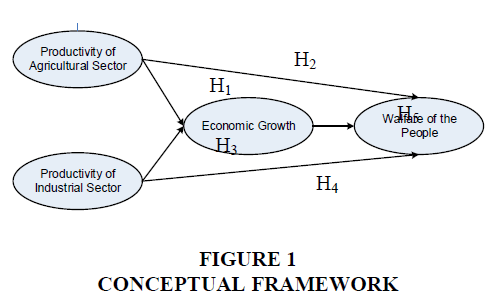

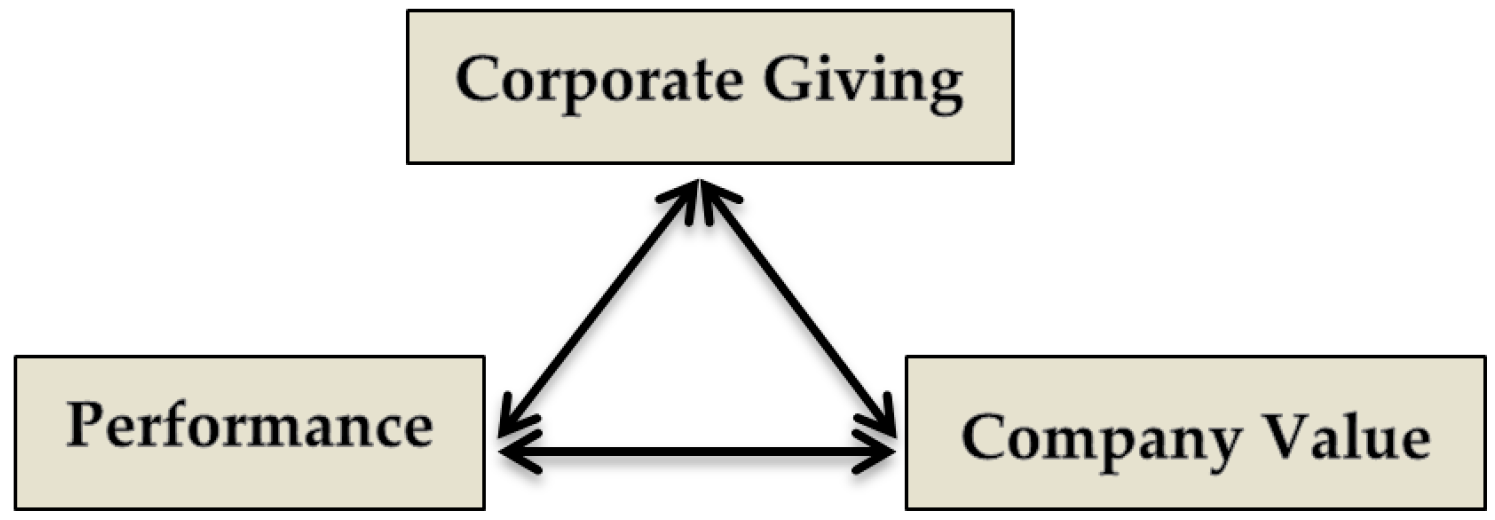

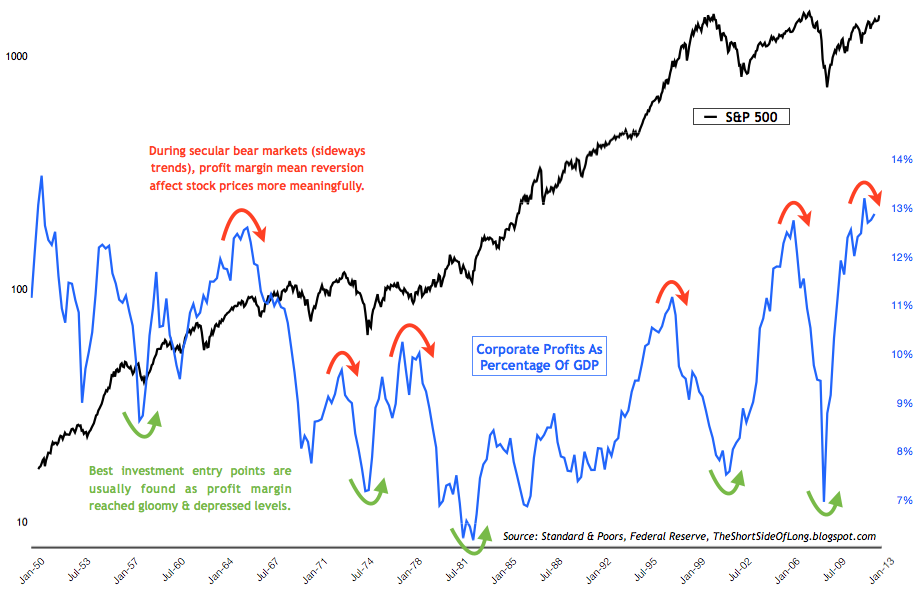

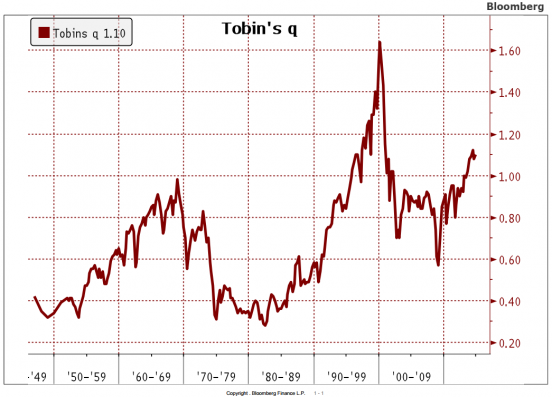

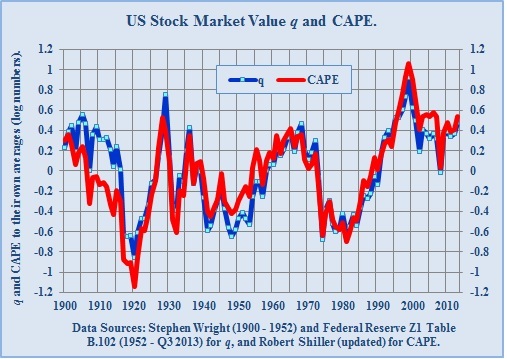

Applications of the q ratio. Comment on samuelson and modigliani. The q ratio can be calculated for the overall market.

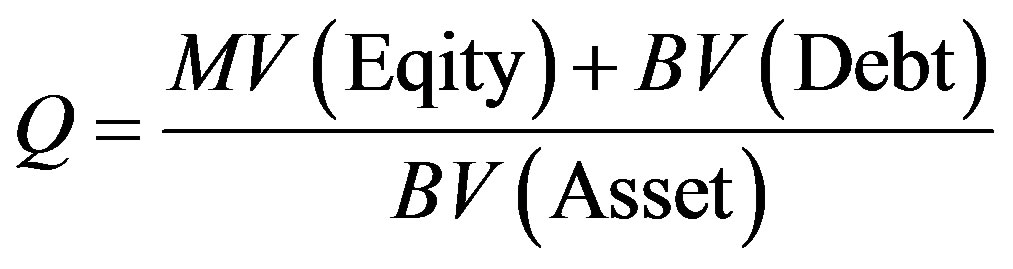

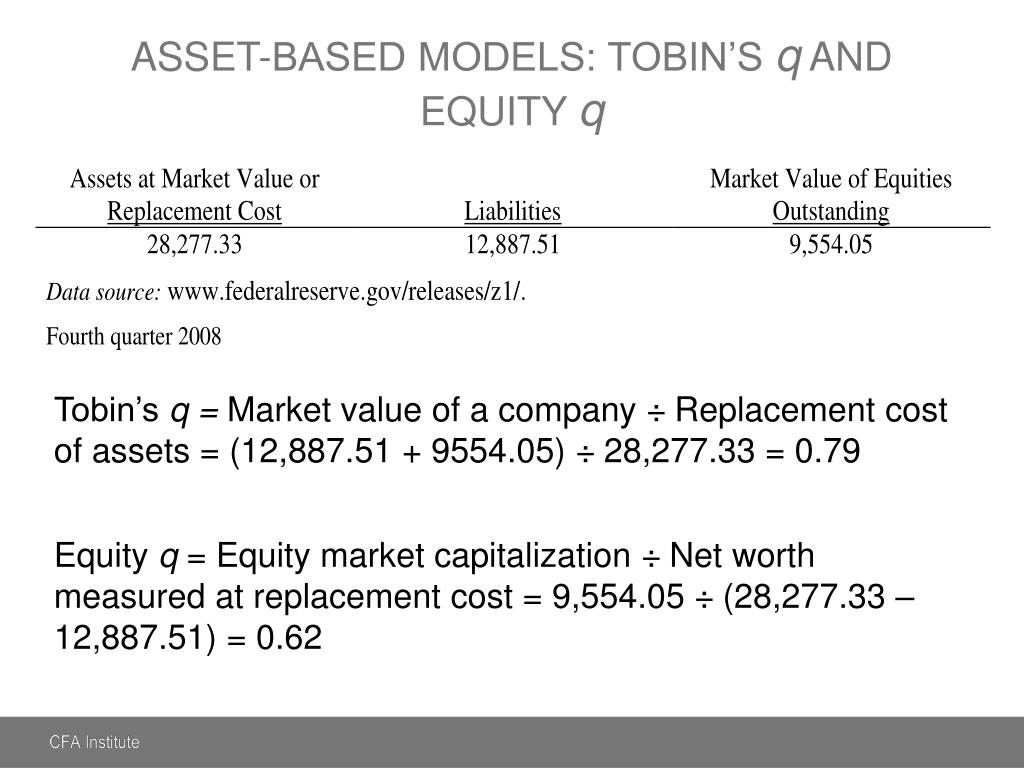

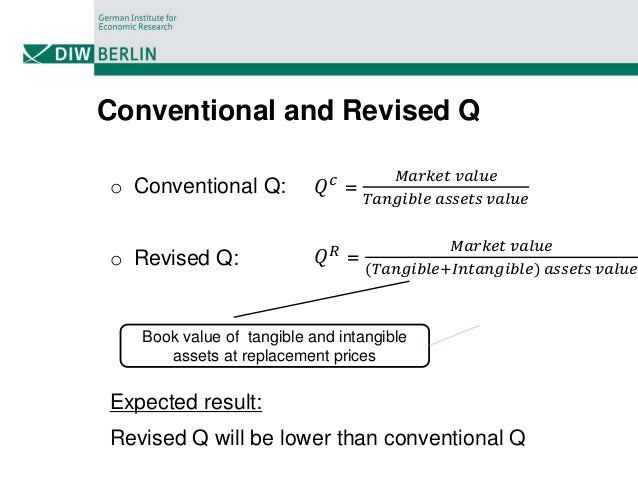

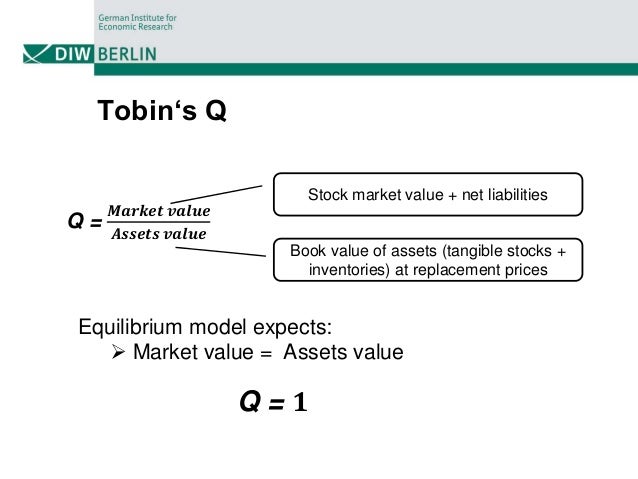

The tobins q ratio formula is devised by james tobin of yale university. Tobins q is the ratio between a physical assets market value and its replacement value. Tobins q ratiofracequity liabilities market valueequity liabilities replacement value as replacement value is hard or impossible to come by usually book value is a reasonable approximation.

Why does tobins q ratio matter. It was popularised a decade later however by james tobin who describes its two quantities. Tobins q can be calculated using the following equation.

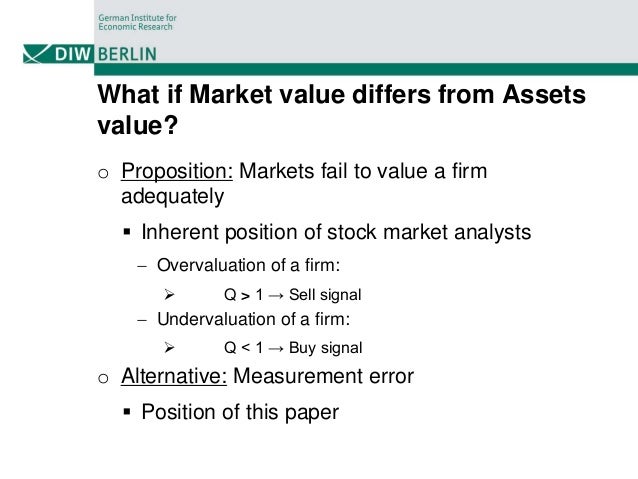

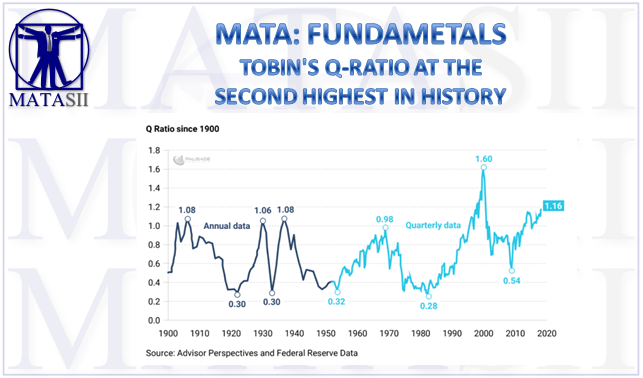

The q ratio is the total price of the market divided by the replacement cost of all its companies. Texttobins qfractextmarket value of assetstextreplacement value of assets market value of assets equals the market value of equity and market value of debt. However in real life it is very difficult to estimate the replacement costs of total assets.

Tobins q total asset value of firm total market value of firm with the above formula the tobins q ratio divides the total market value of a firm by the total value of assets owned by the firm. Just divide the total market value of firm by the total asset value of firm to calculate the ratio. The going price in the market for exchanging existing assets.

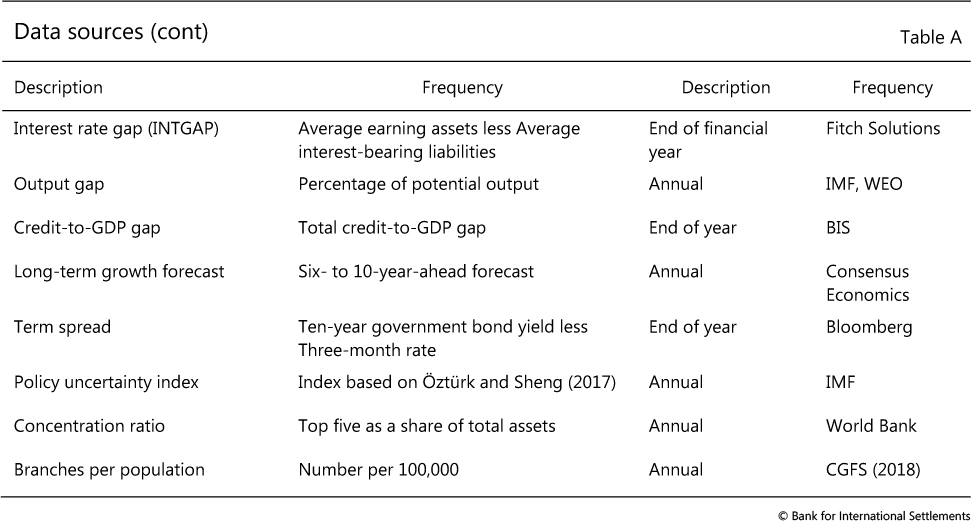

This ratio hypothesizes the combined market value of all the companies on the stock market. For example assume that a company has 35 million in assets. The ratio is calculated using the z1 flow of funds report.

The formula for tobins q ratio takes the total market value of the firm and divides it by the total asset value of the firm. The original formula for the q ratio is. Tobins q is the market value of all public companies in the us divided by their replacement cost.

Using the formula we can calculate that tobins q is. It was first introduced by nicholas kaldor in 1966 in his article marginal productivity and the macro economic theories of distribution. Its a fairly simple concept but laborious to calculate.

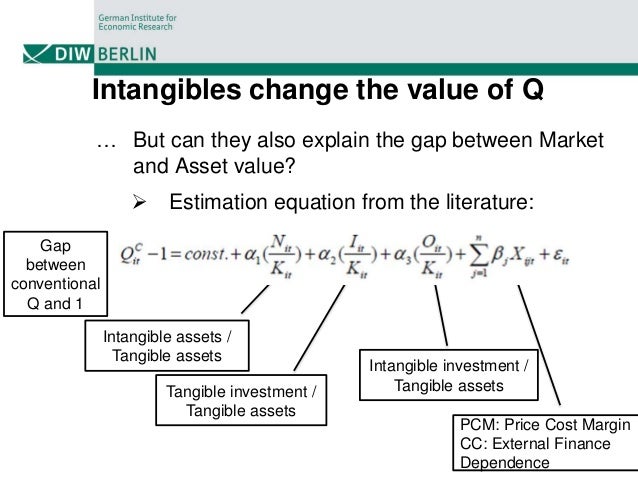

Thus there is a modification of the original formula in which the replacement costs of the assets are replaced with their book values.

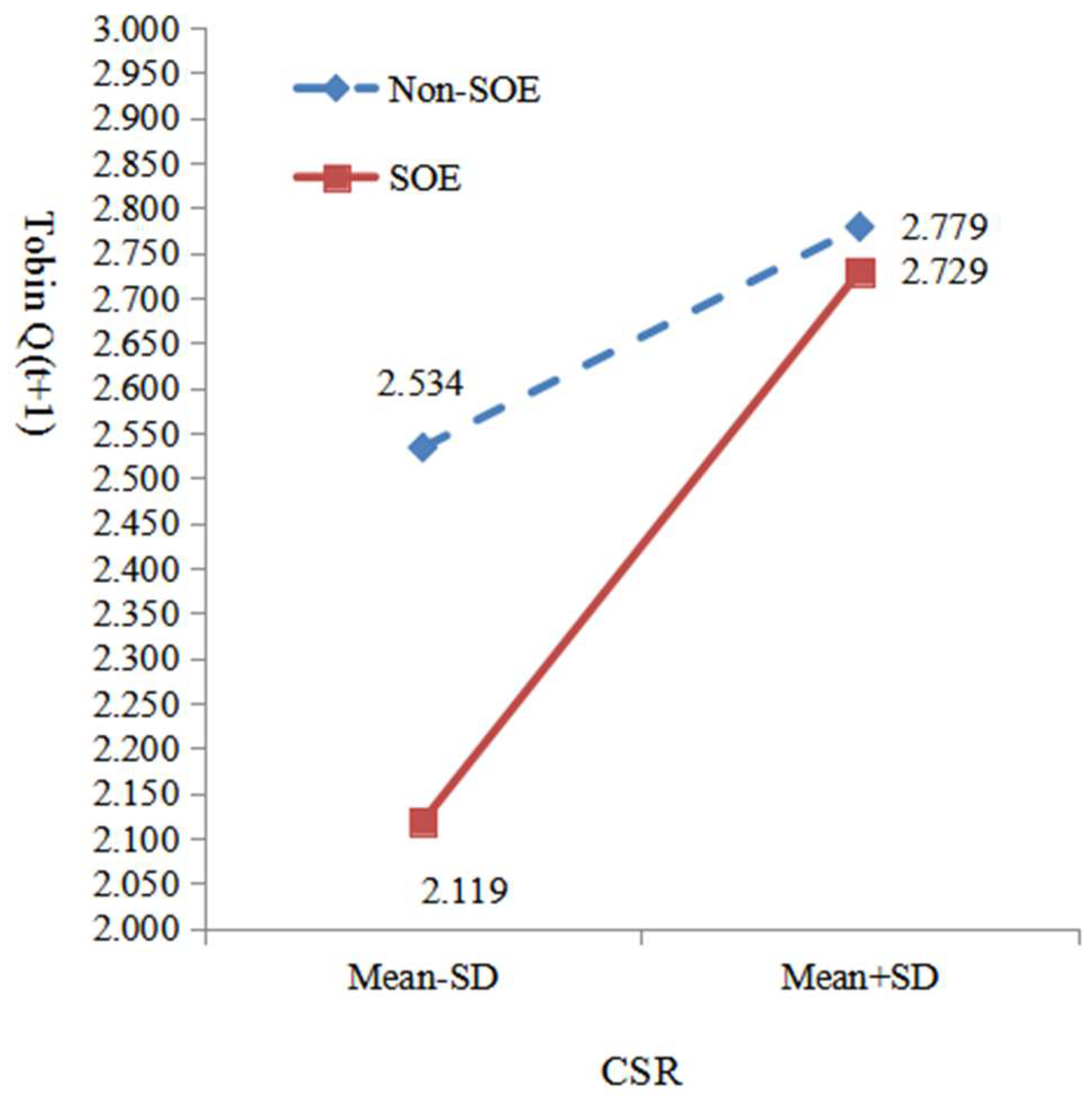

On The Long Run Equilibrium Value Of Tobin S Average Q European Journal Of Economics And Economic Policies

www.elgaronline.com

The Q Ratio And Market Valuation August Update Dshort Advisor Perspectives

www.advisorperspectives.com

The Effect Of Enterprise Risk Management Erm On Firm Value In Manufacturing Companies Listed On Indonesian Stock Exchange Year 2010 2013 Emerald Insight

www.emerald.com

Corporate Governance And The Relationship Between Eva And Created Shareholder Value Emerald Insight

www.emerald.com

The Q Ratio And Market Valuation August Update Dshort Advisor Perspectives

www.advisorperspectives.com

/success-4636691_1920-7760904d262f4a90b3e199a8b970c1c3.jpg)