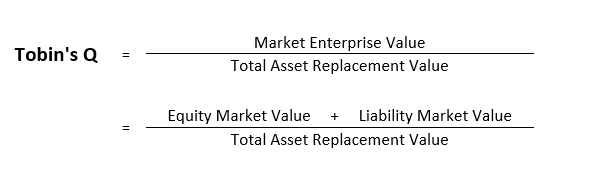

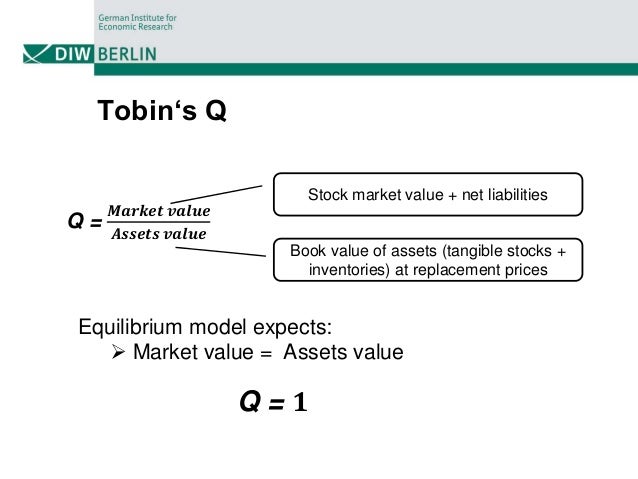

Tobins Q Ratio Formula

The ratio was popularized in the 1970s by yales james tobin.

Tobins q ratio formula. Tobins q can be calculated using the following equation. It was popularised a decade later however by james tobin who describes its two quantities. What is the q ratio.

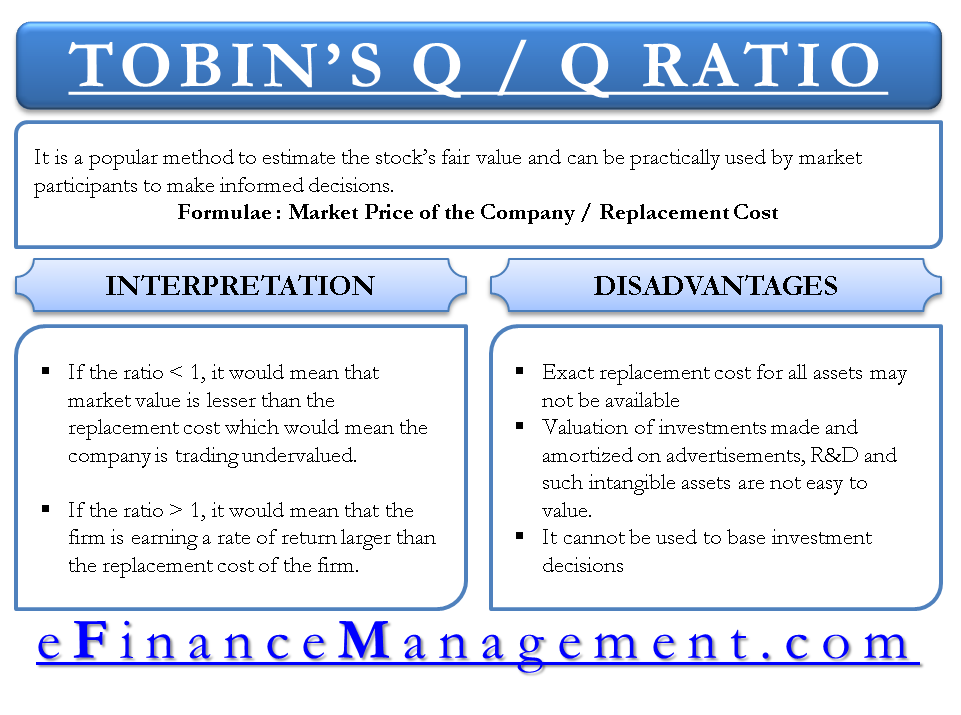

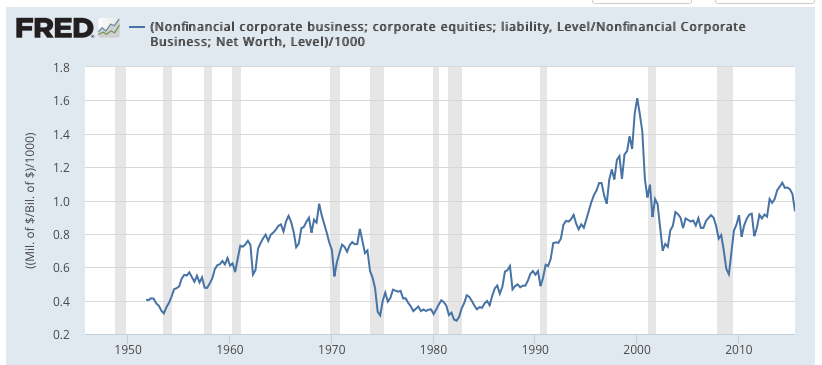

Tobins q 10000000 x 3 40000000 075 james tobin a nobel prize winner in economics and a professor at yale university developed the ratio after hypothesizing that companies should be worth what they cost to replace. Using the formula we can calculate that tobins q is. Q usd 50000000 usd 90000000 05 based on the conclusions given above we can say that in case of company a which has a q ratio less than 1 the market value is less than the value of its assets.

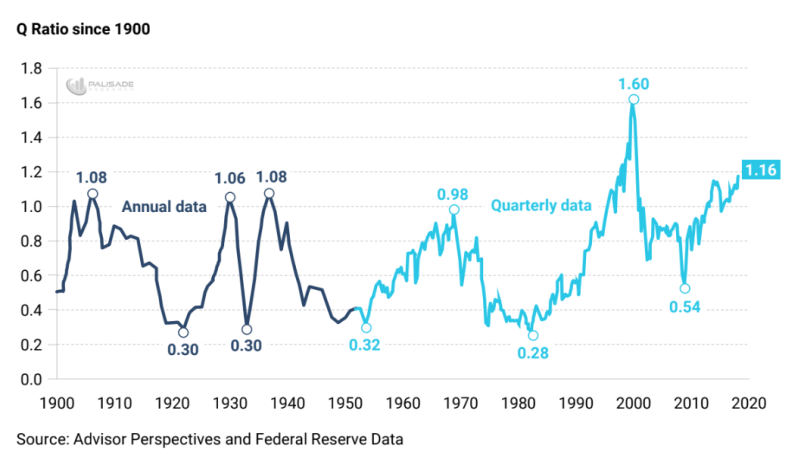

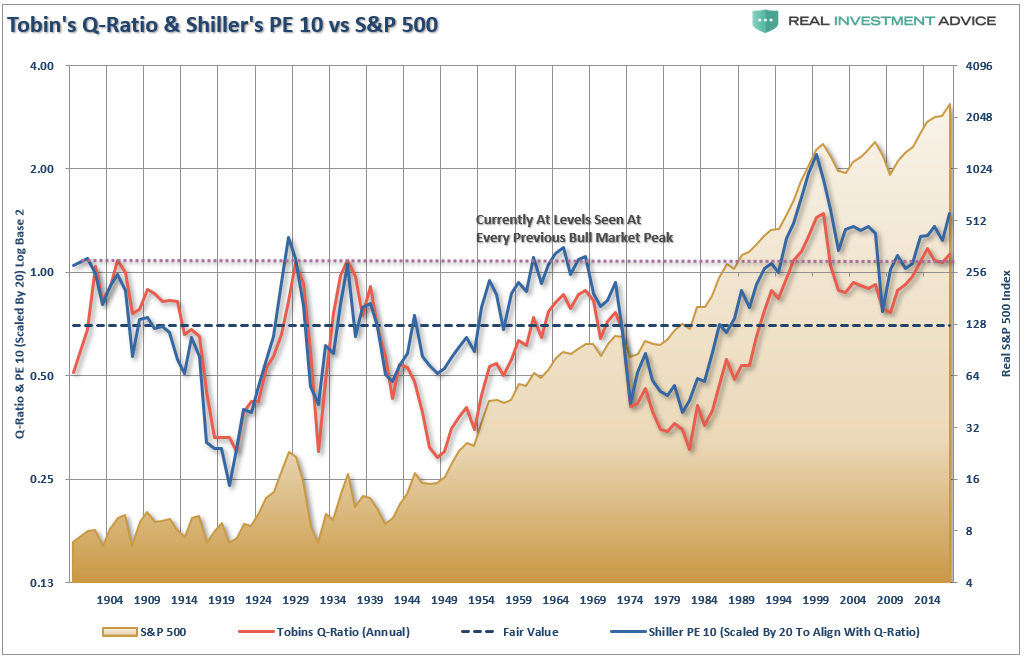

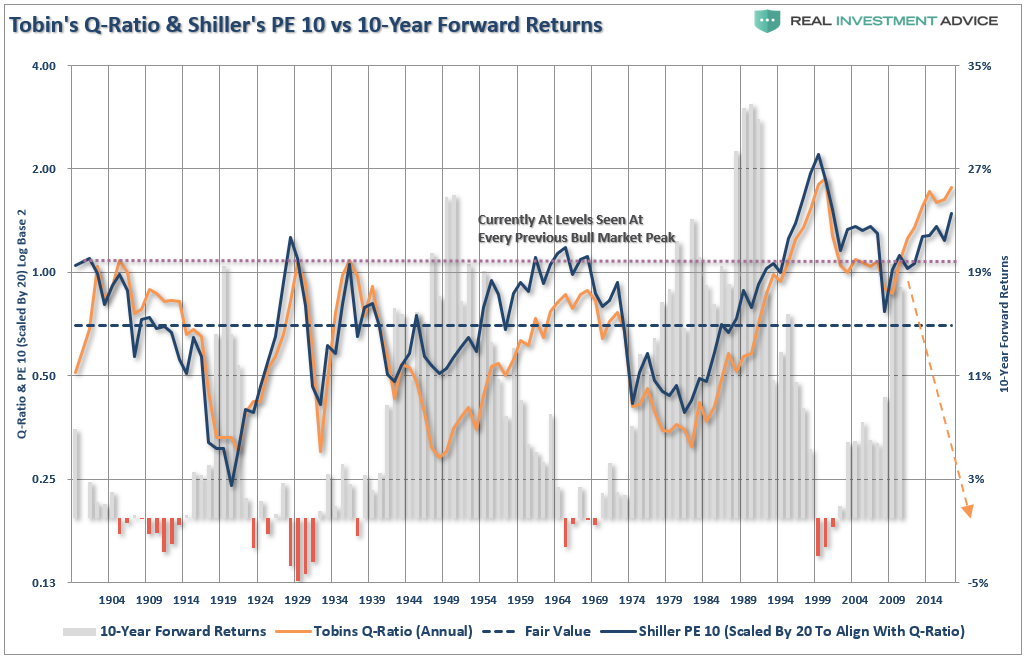

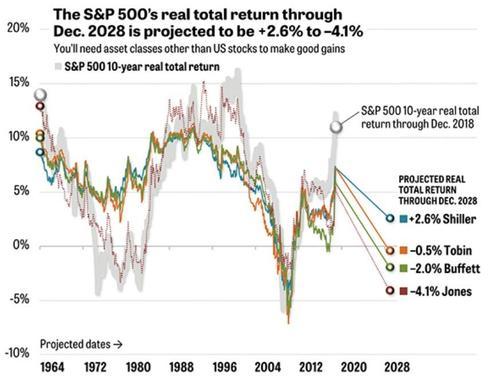

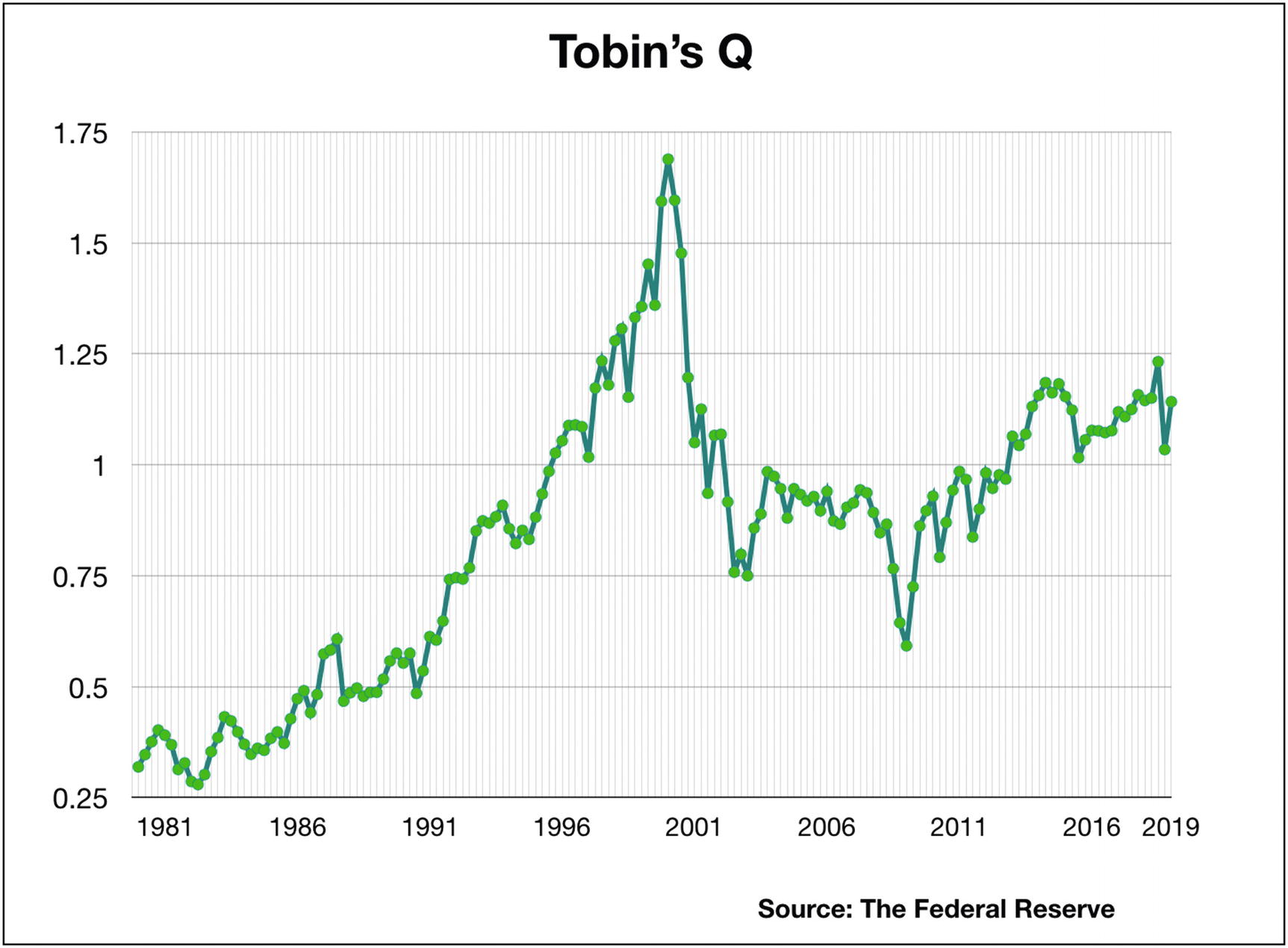

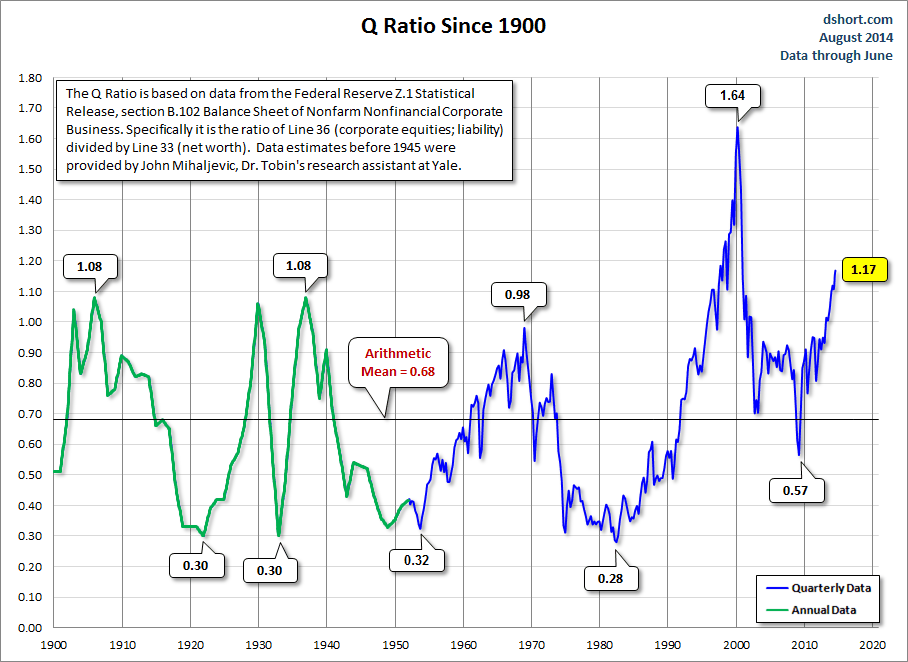

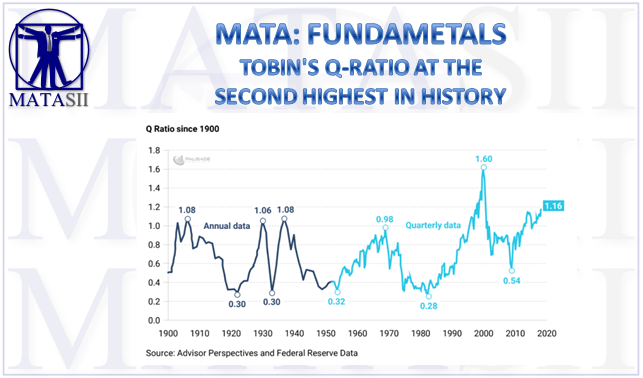

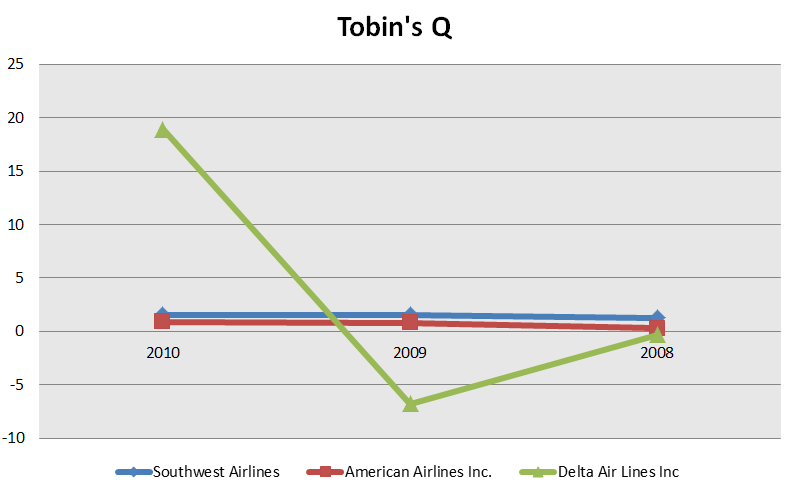

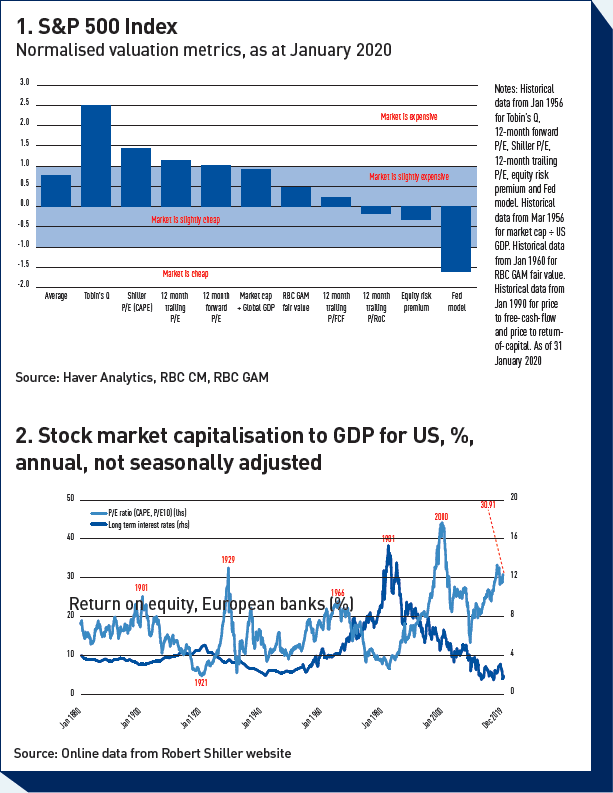

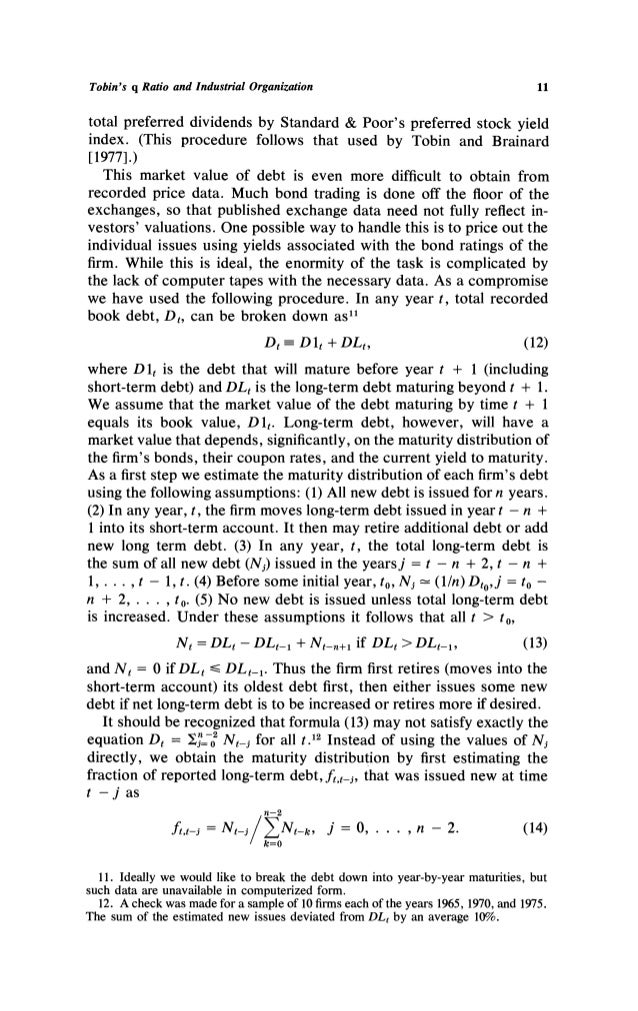

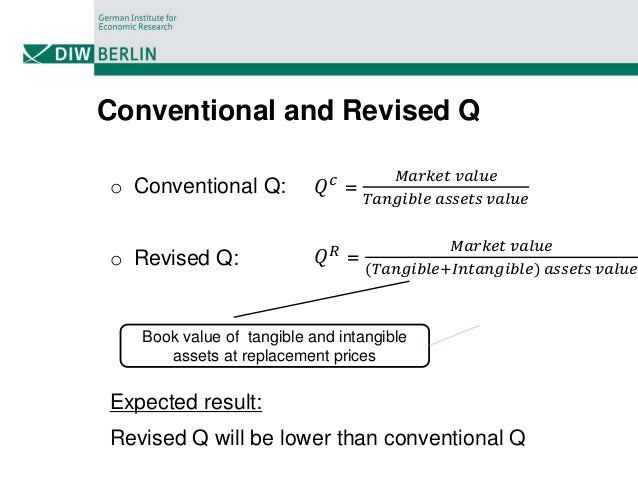

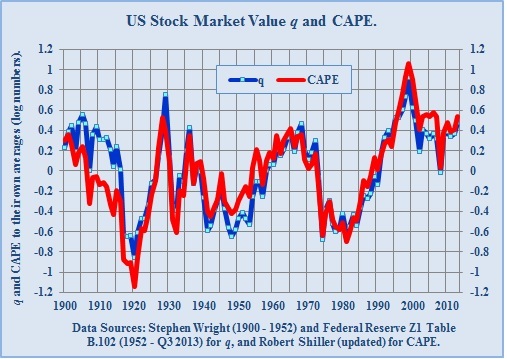

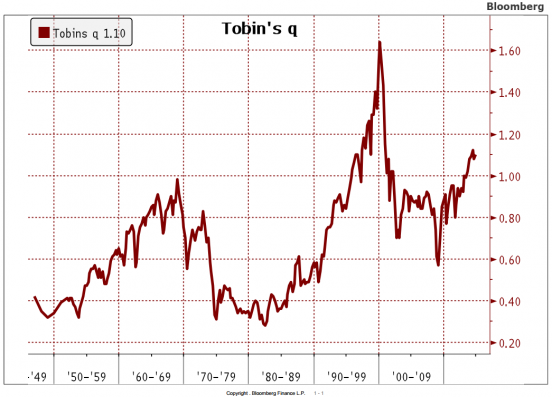

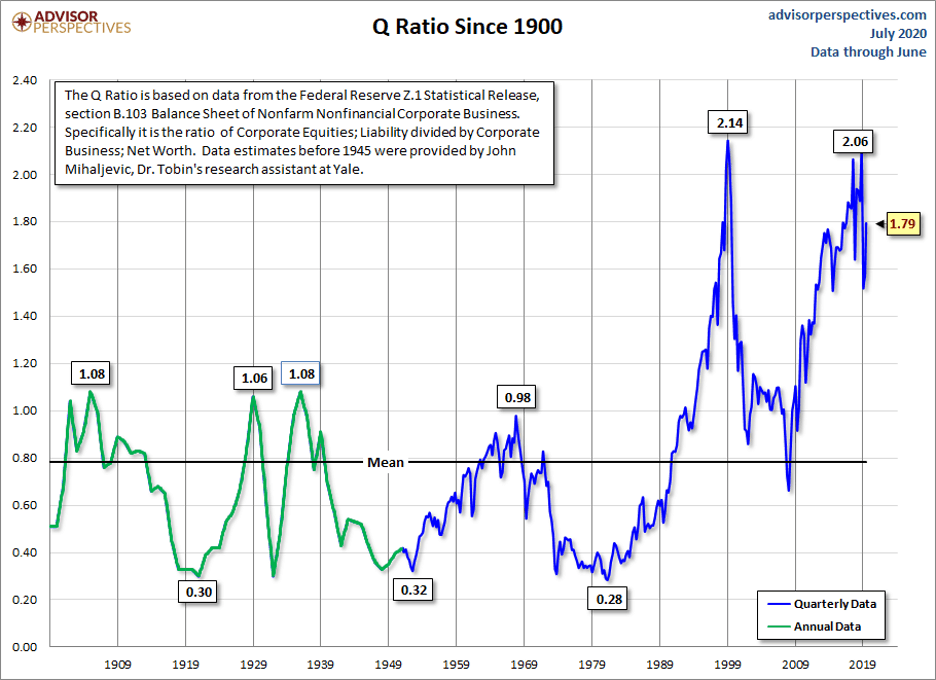

Dengan adanya modal intelektual inilah yang menjadi salah satu faktor kenapa pasar memberikan penilaian lebih. A very high ratio relative to historical trend might indicate that the stock market is overvalued and vice versa. Tobins q also known as q ratio and kaldors v is the ratio between a physical assets market value and its replacement valueit was first introduced by nicholas kaldor in 1966 in his article marginal productivity and the macro economic theories of distribution.

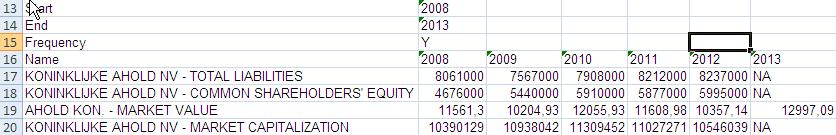

Its sometimes referred to by the shorthand q ratio. Its a fairly simple concept but laborious to calculate. Terkhusus q ratio atau tobins q juga sering dipakai sebagai alat ukur untuk menilai intellectual capital suatu perusahaan.

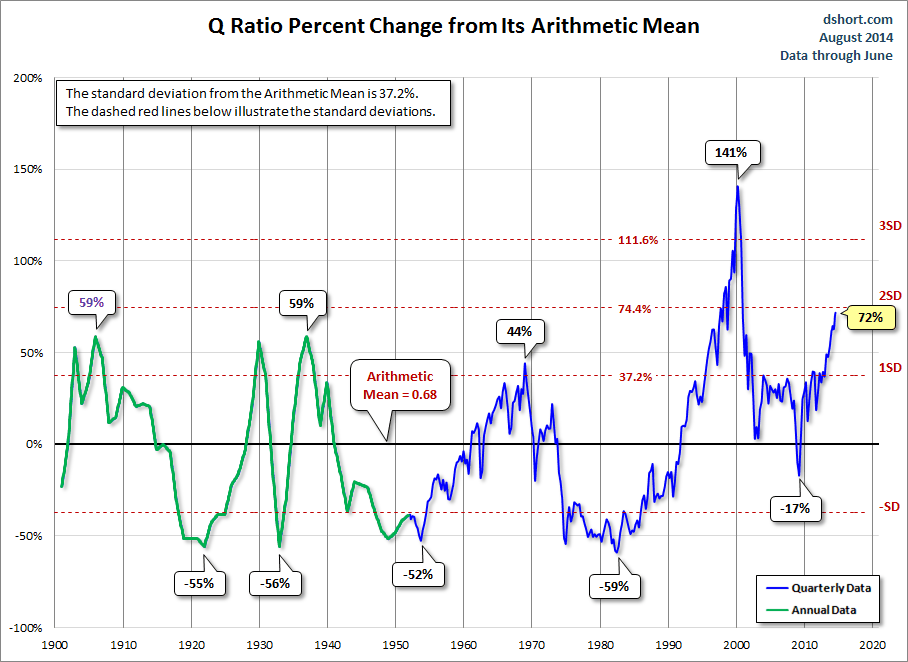

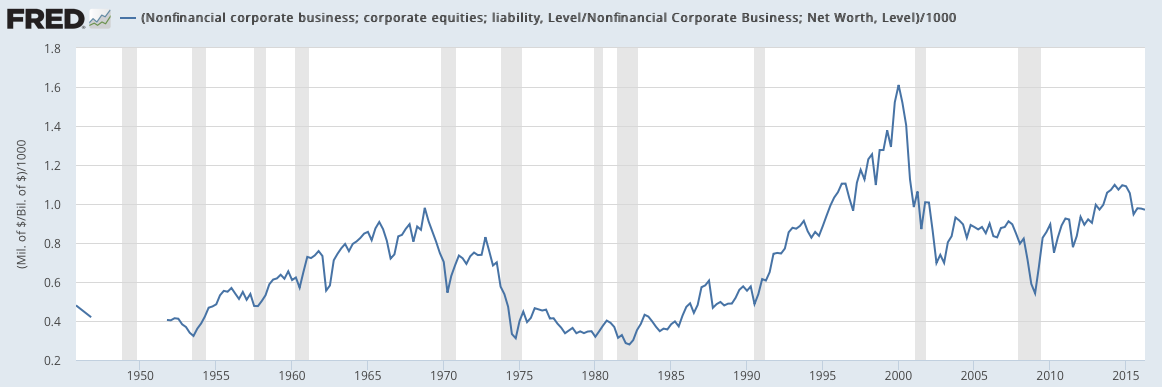

Misalnya seperti apa kekuatan monopoli perusahaan peluang pertumbuhan dan sistem manajemen perusahaan. The q ratio or tobins q ratio is a ratio between a physical assets market value and its replacement value. Tobins q is the market value of all public companies in the us divided by their replacement cost.

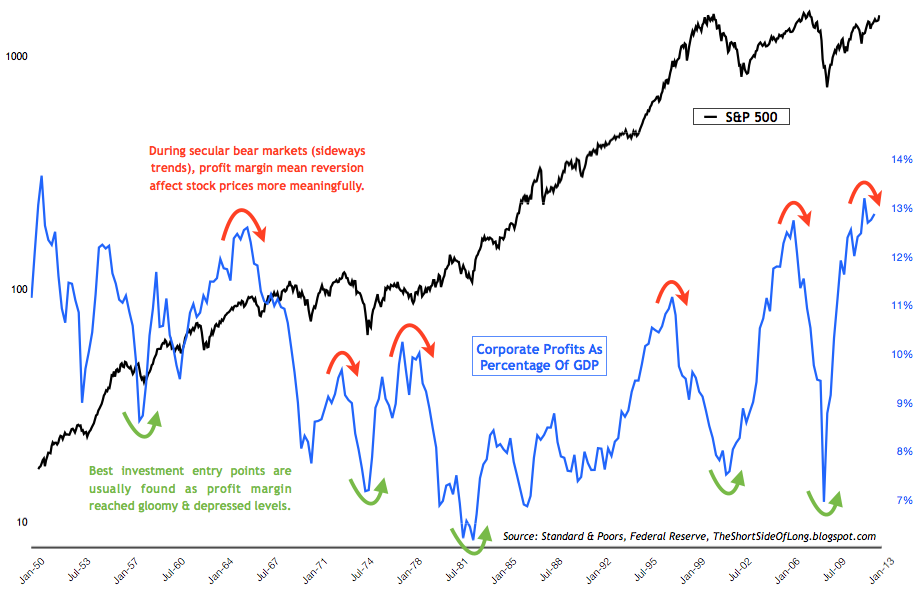

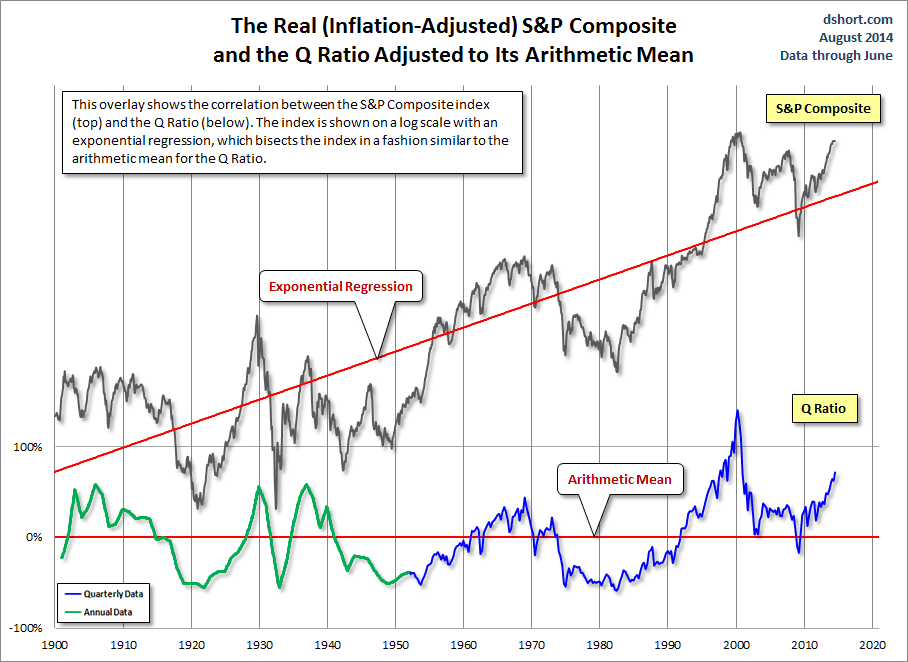

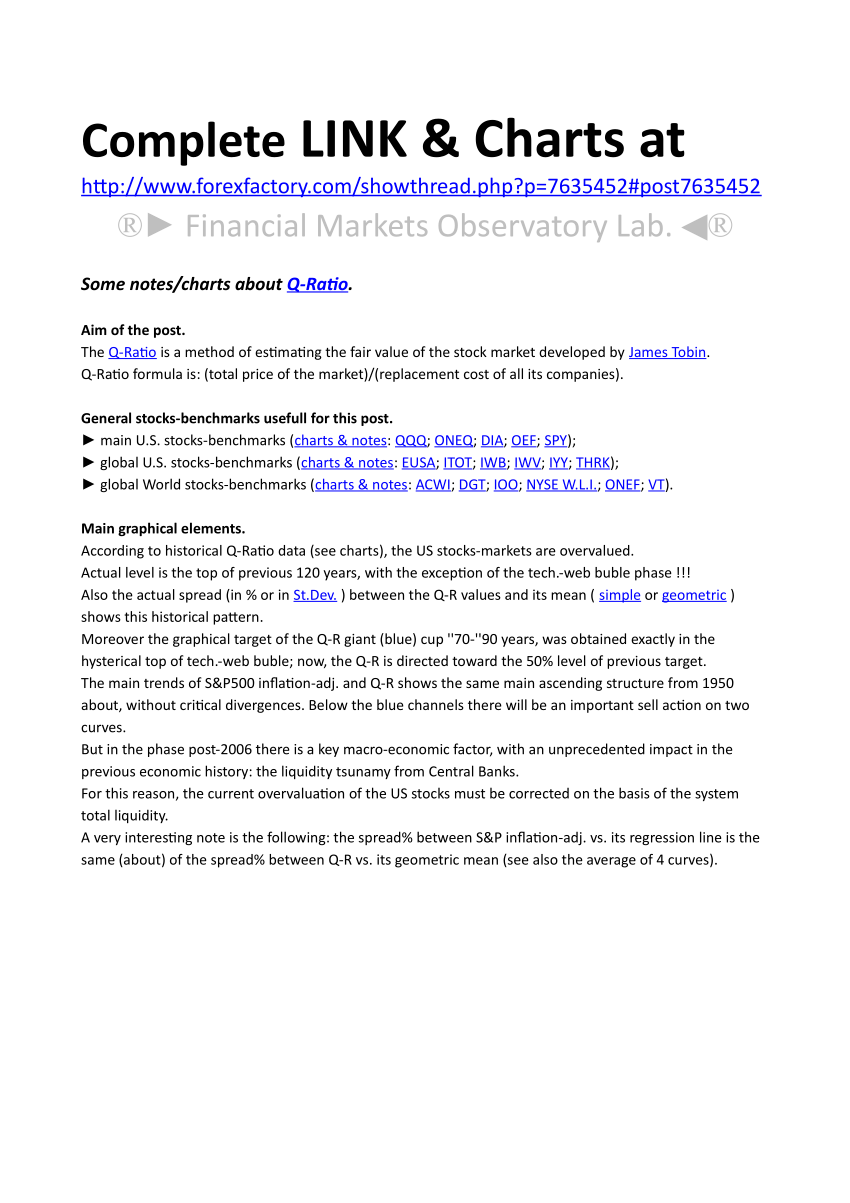

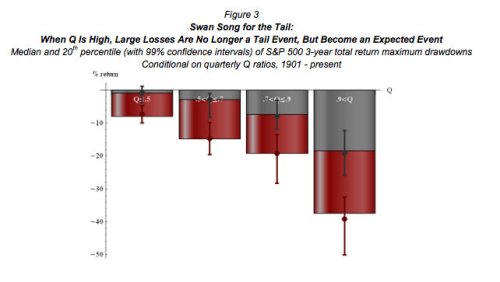

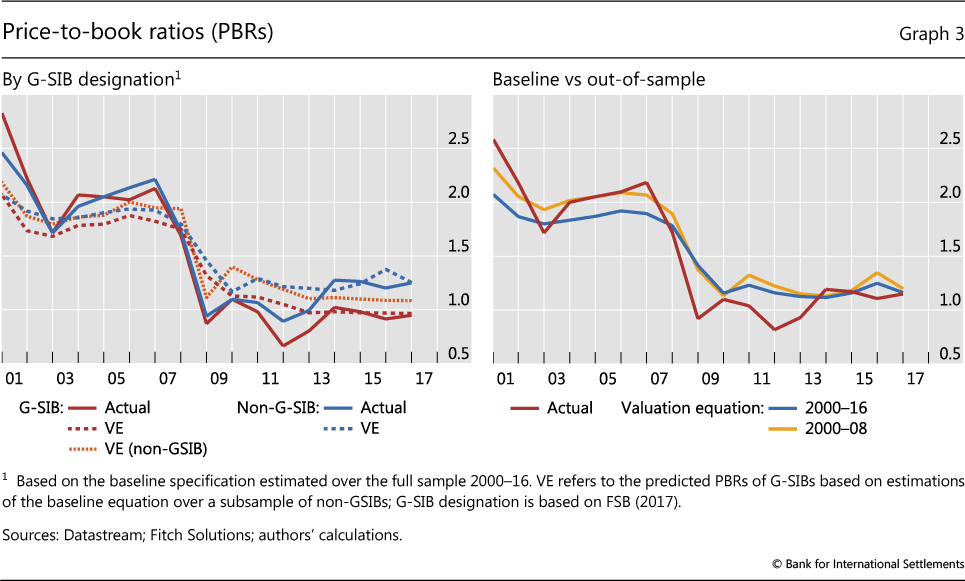

The ratio is calculated using the z1 flow of funds report. The ratio was developed by james tobin a nobel laureate in economics. Many macroeconomists consider the market overvalued when tobins q is above its long term mean and undervalued when it is below the long term mean.

For example assume that a company has 35 million in assets. The q ratio is the total price of the market divided by the replacement cost of all its companies. Tobins q or the tobin q ratio is the market value of a security or market divided by its asset replacement cost.

The formula for tobins q ratio takes the total market value of the firm and divides it by the total asset value of the firm. The q ratio is a popular method of estimating the fair value of the stock market developed by nobel laureate james tobin. The tobins q ratio can also be utilized as an indicator of overall stock market valuation.

Databaser On Financial Databases Tobin S Q Ratio What Is And Where Can I Find It

finabase.blogspot.com

/success-4636691_1920-7760904d262f4a90b3e199a8b970c1c3.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1178054155-32bd82a098824bfa9c2ffd5f82aa3258.jpg)