T Bill Price Formula Excel

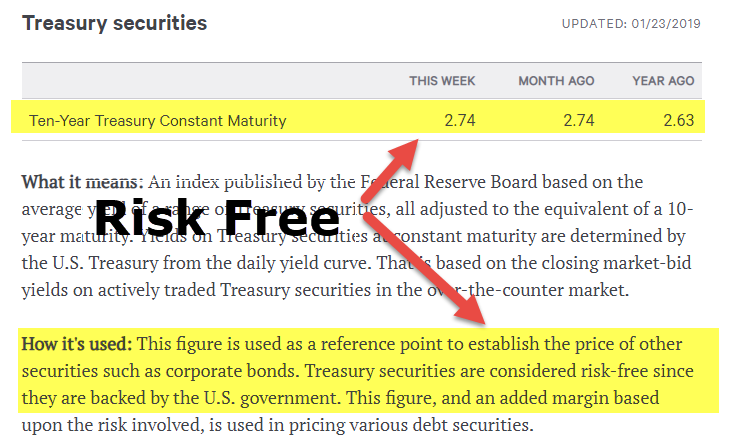

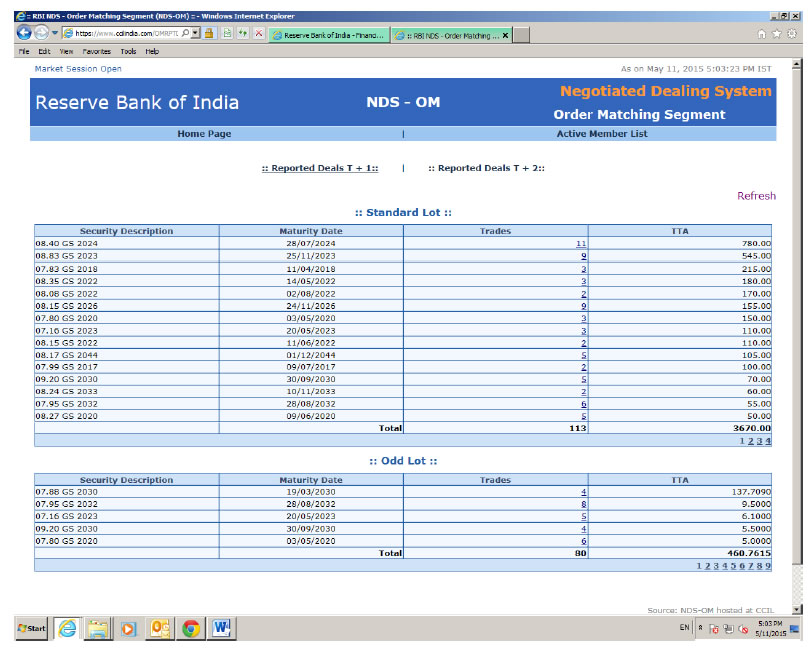

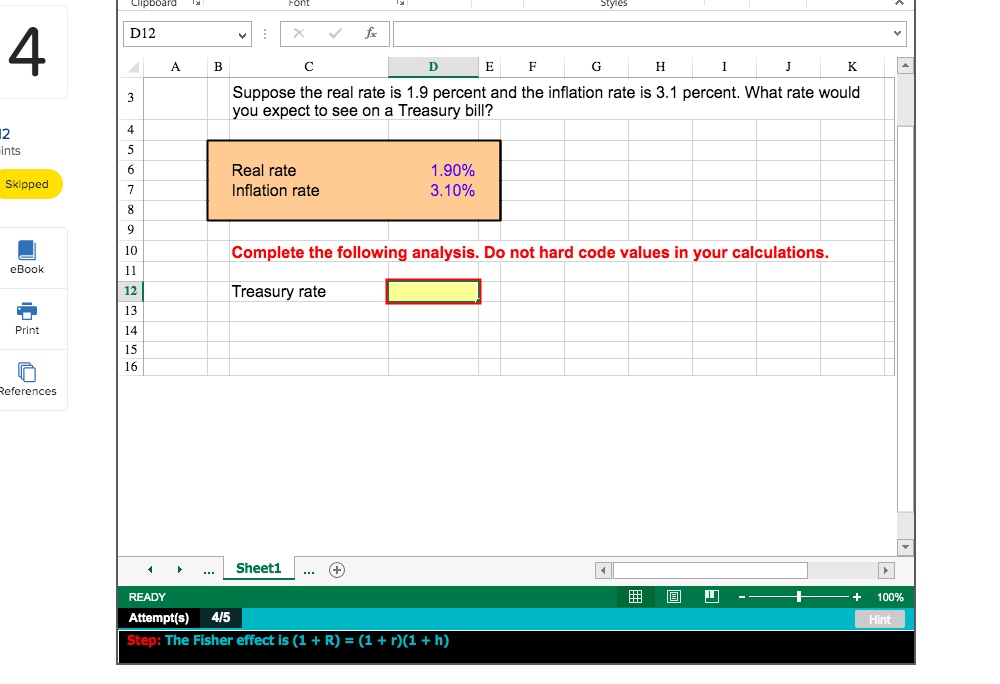

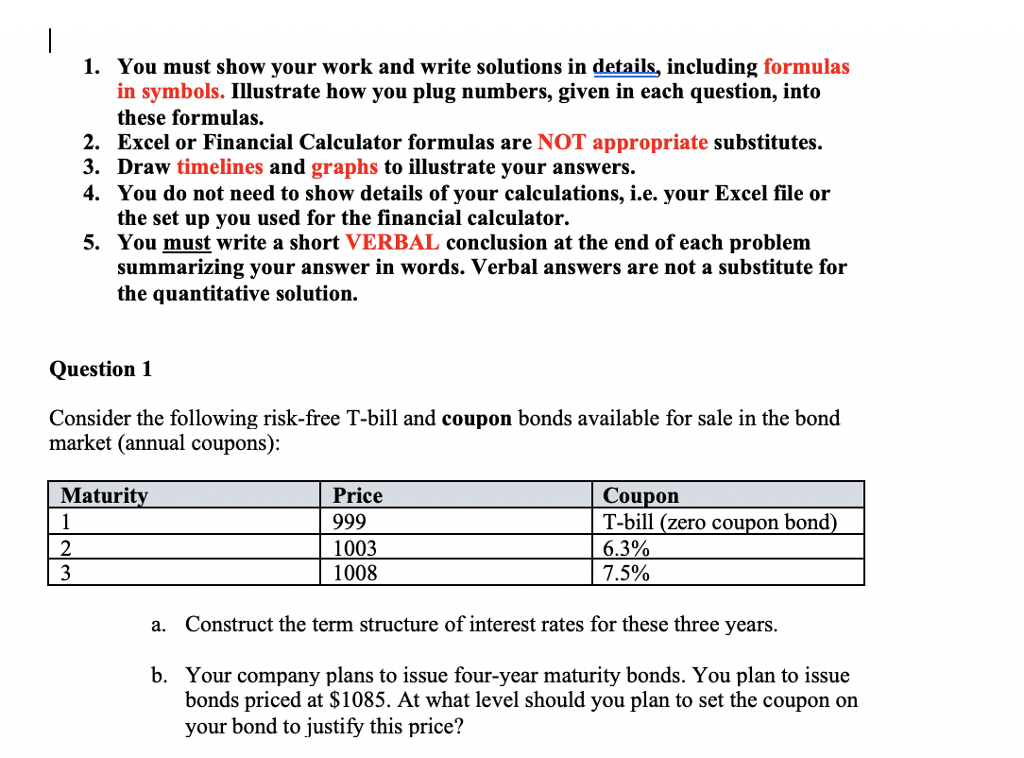

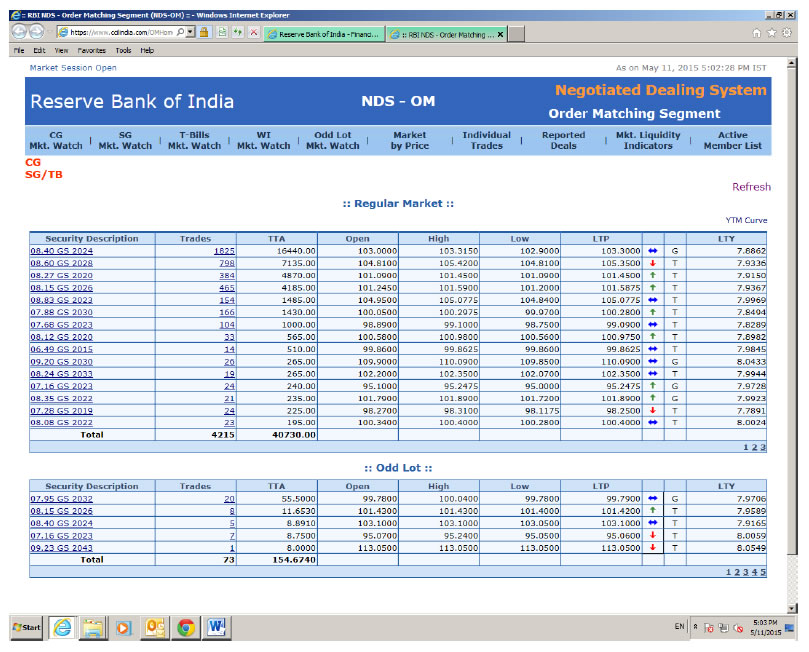

A t bill or treasury bill is a government investment that lasts less than one year.

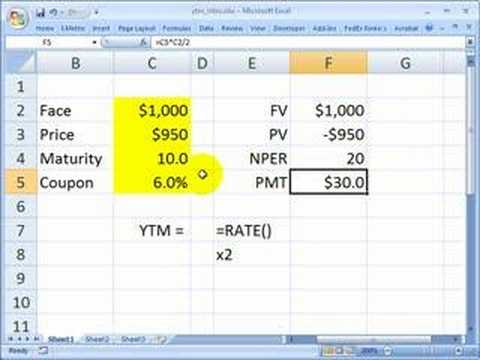

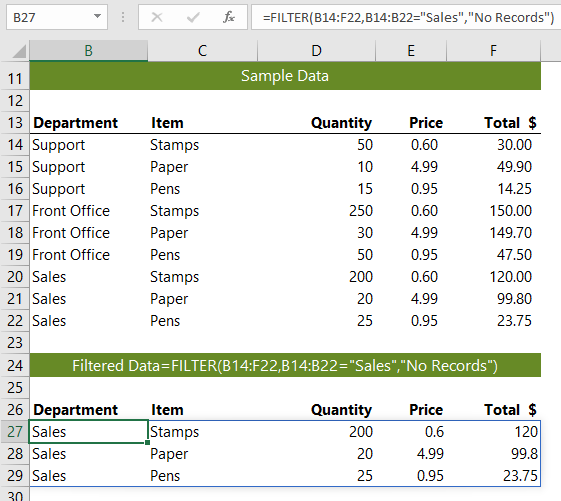

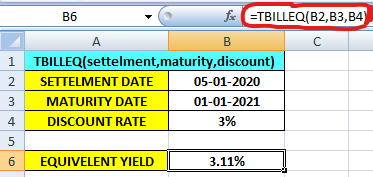

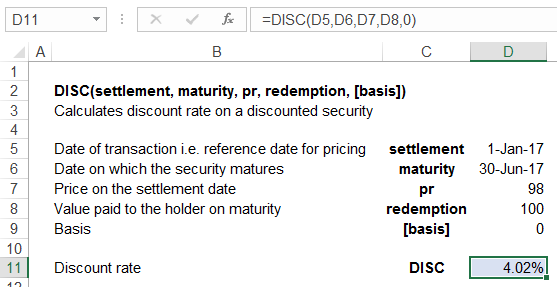

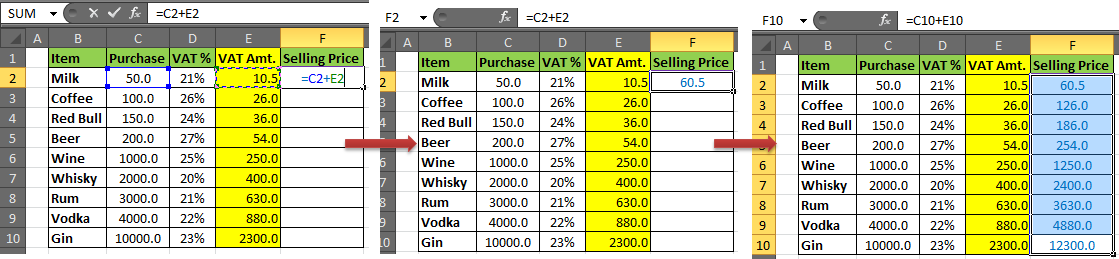

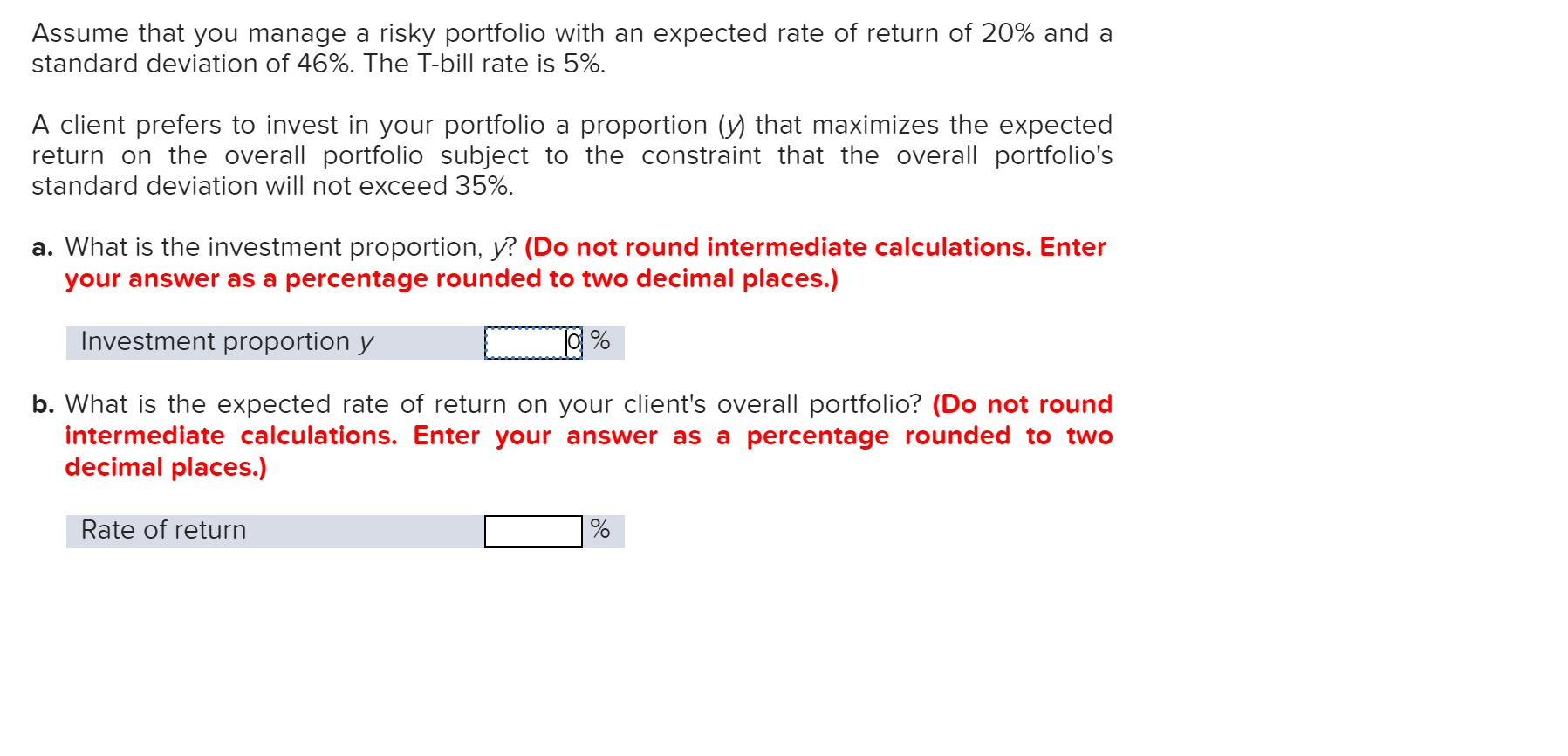

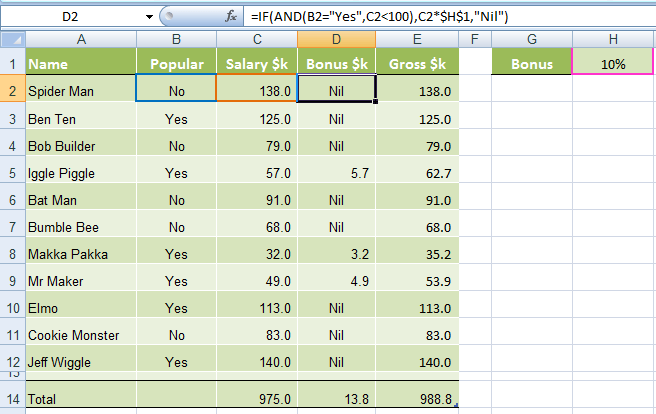

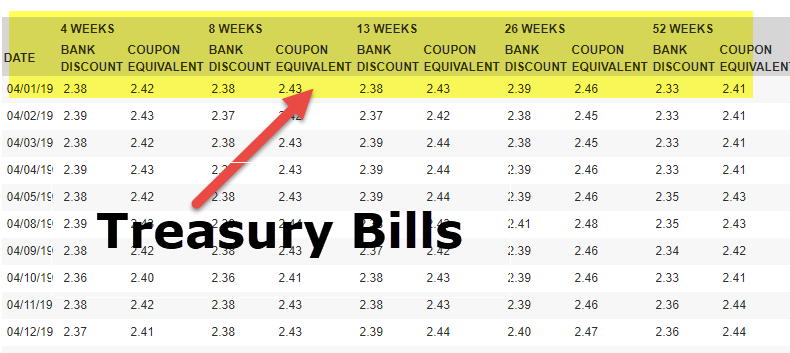

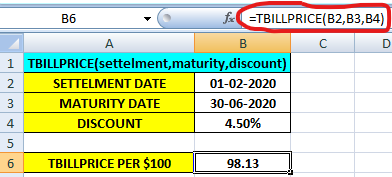

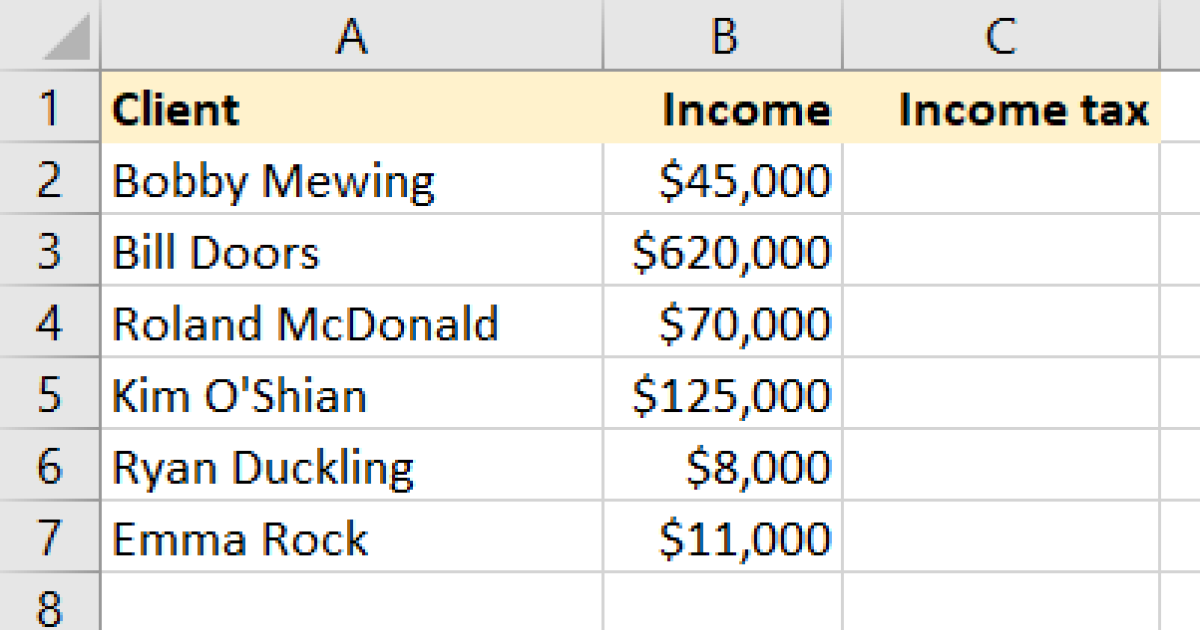

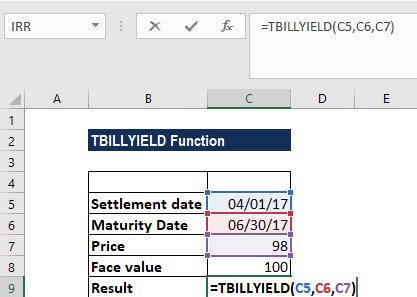

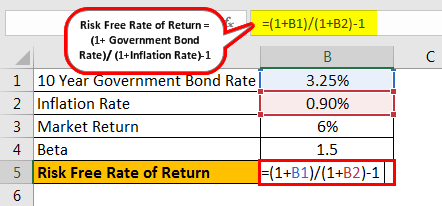

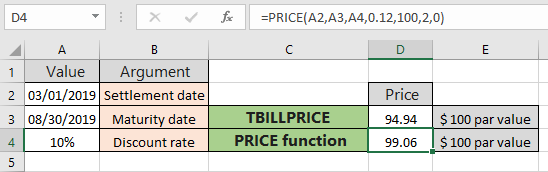

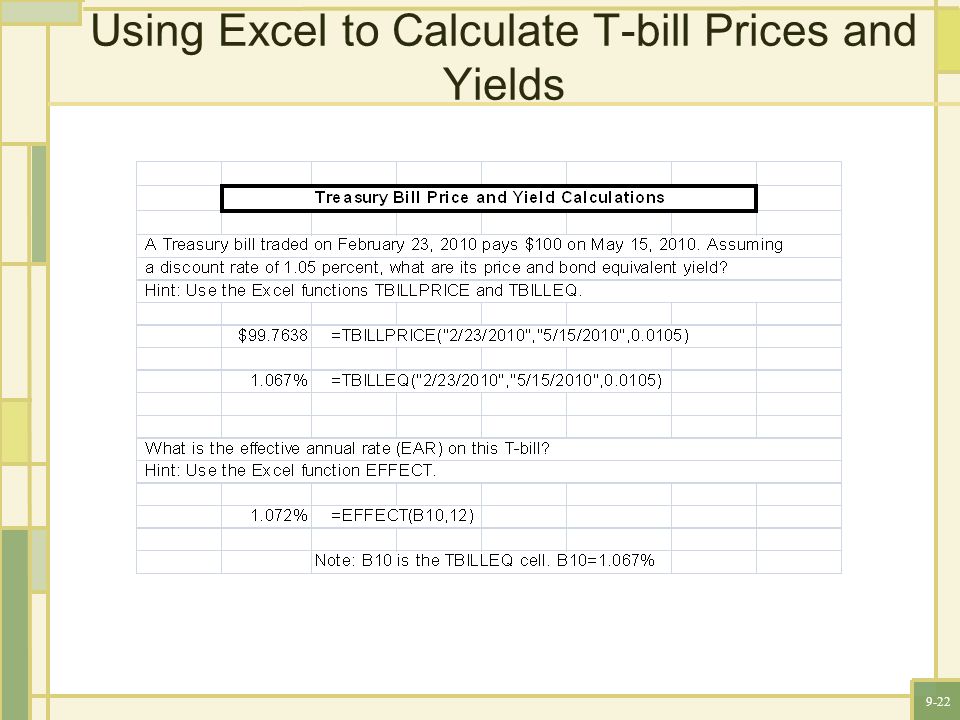

T bill price formula excel. The excel tbilleq function returns the bond equivalent yield for a treasury bill based on based on a settlement date a maturity date and a discount rate. The following spreadsheet shows the excel tbillprice function used to calculate the price per 100 face value of a treasury bill with settlement date 01 feb 2017 maturity date 30 jun 2017 and a discount rate of 275. In excel you can find that value using the t bill price function.

Well demonstrate this calculation using the tbillprice0508 sample workbook. With these inputs the tbillprice function returns a price per 100 of 9754 with currency number format applied. The maturity date is the date when the t bill expires.

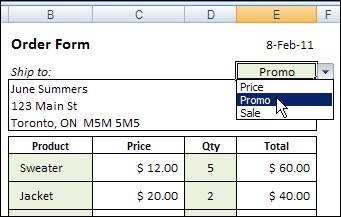

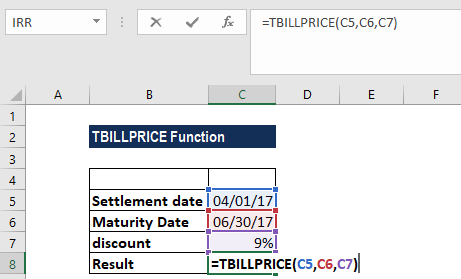

Pr required argument the t bills price per 100 face value. To illustrate lets look at an example. The function will calculate the fair market value of a treasury bill bond.

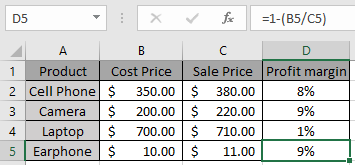

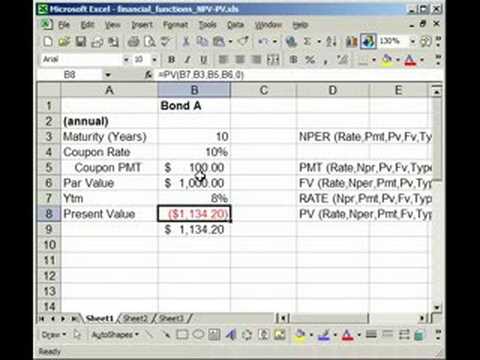

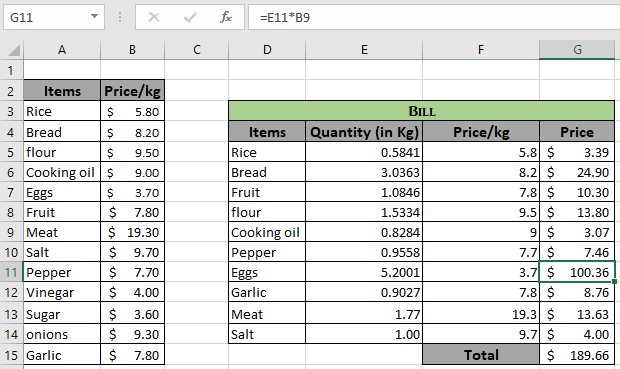

The tbillprice function in microsoft excel is used to calculate the price per 100 face value of a treasury bill. The tbillprice function is categorized under excel financial functions. To convert the face value of 1000 in cell c5 to a price using the value returned by tbillprice f6 contains this formula.

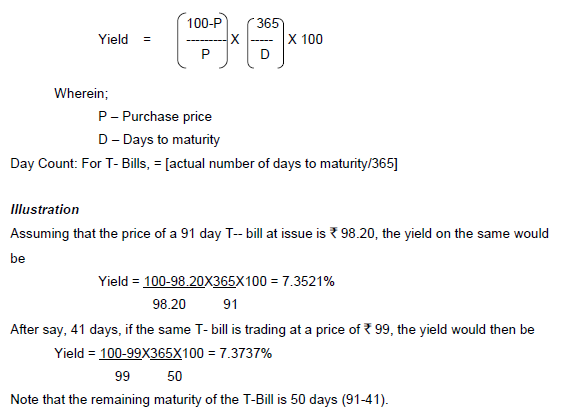

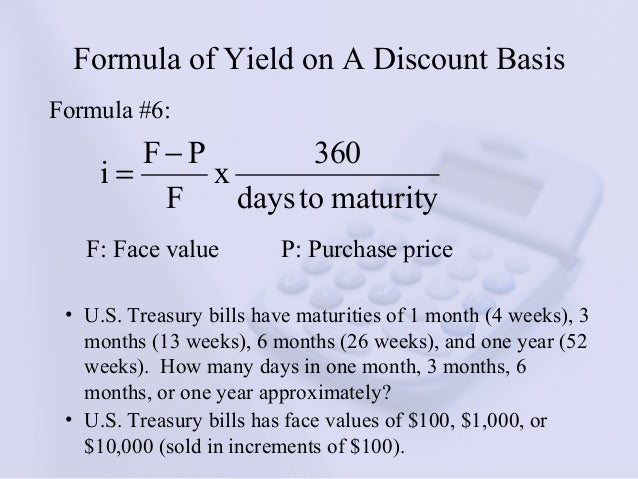

In the example shown the settlement date is 5 feb 2019 the maturity date is 1 feb 2020 and the discount rate is 254. Then divide by 360 to get 075 and subtract 100 minus 075. As a worksheet function tbillyield can be entered as part of a formula in a cell of a worksheet.

The answer is 9925. Because youre buying a 1000 treasury. If you wish to use the tbillprice function in microsoft excel then follow.

Lets say you buy a 13 week treasury bill 91 days to maturity at a price of 990. To calculate the price take 180 days and multiply by 15 to get 270. The formula in f5 is.

Maturity required argument this is the t bills maturity date. You can find that in the chapter five folder of the exercise files collection. In financial analysis tbillprice can be useful in determining the value of a bond and deciding if an investment should.

This will give you the t bills annualized investment return.

/16c2bc813fac68e26f0f7aea199a1cc9-dfac742897bb40eea19f17122bebf07e.jpg)

/16c2bc813fac68e26f0f7aea199a1cc9-dfac742897bb40eea19f17122bebf07e.jpg)