Pf Formula Economics

A simple example would be to take the 1000 and put it in a savings account at 2 interests.

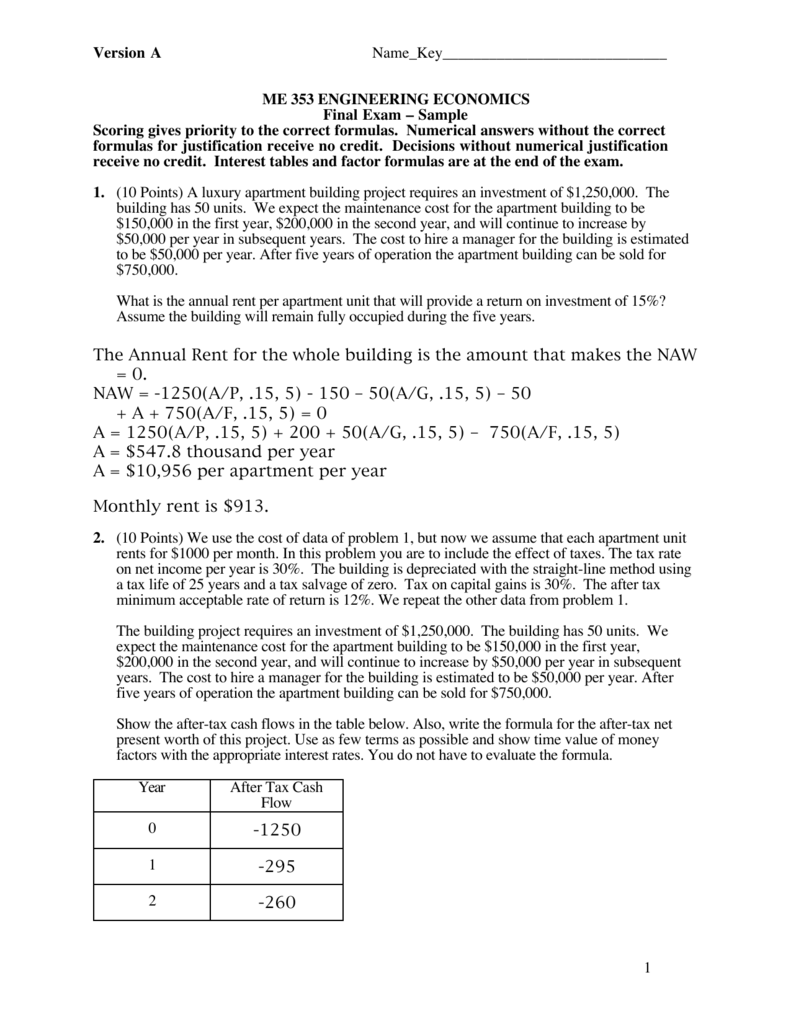

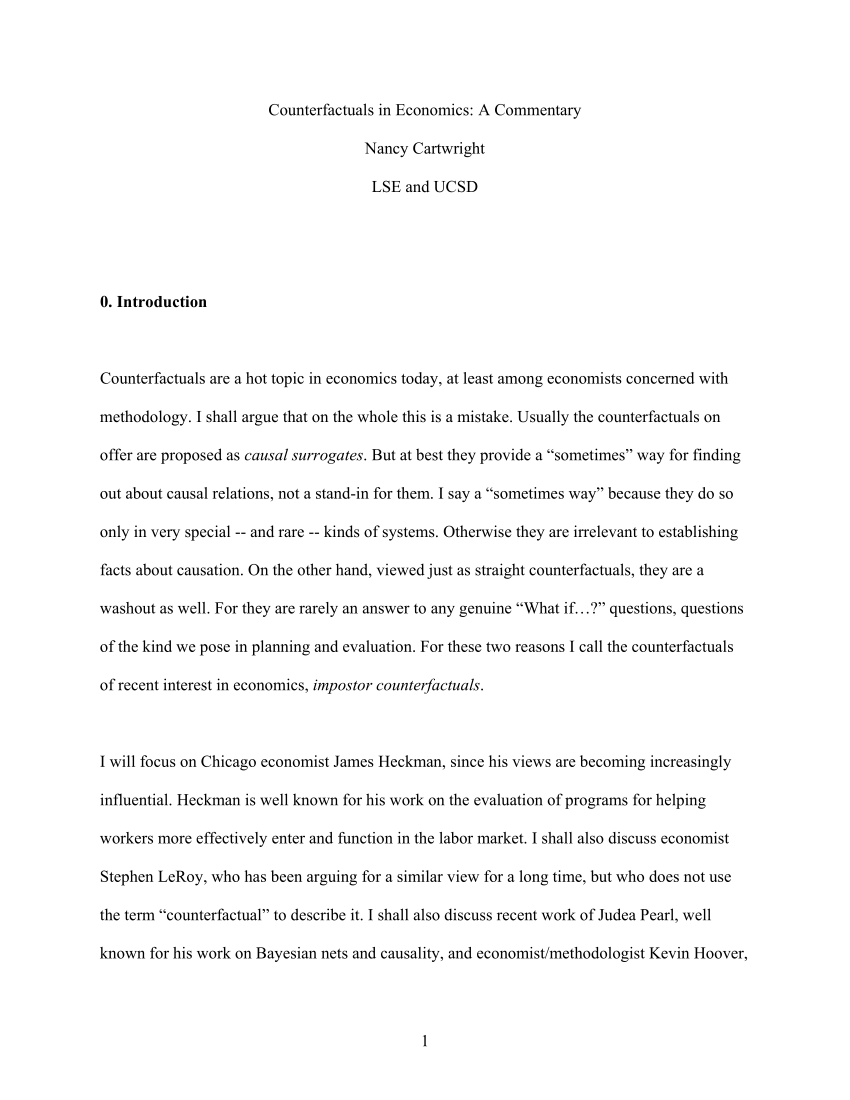

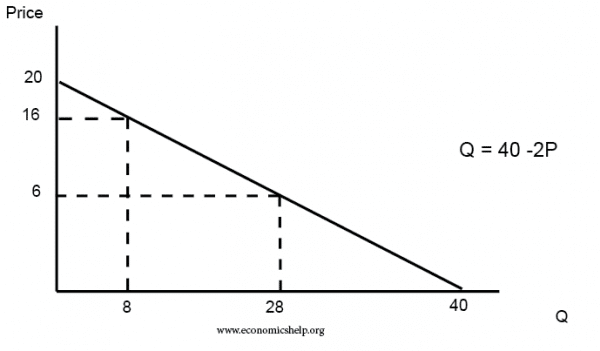

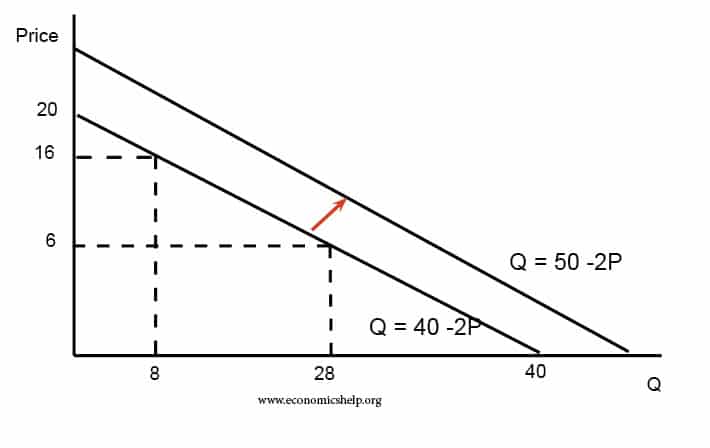

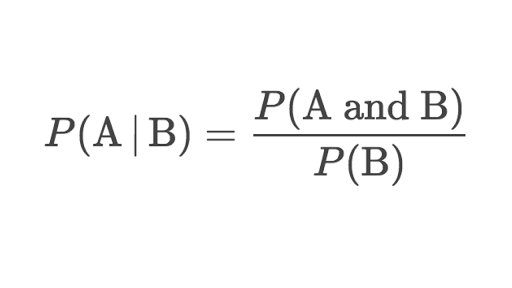

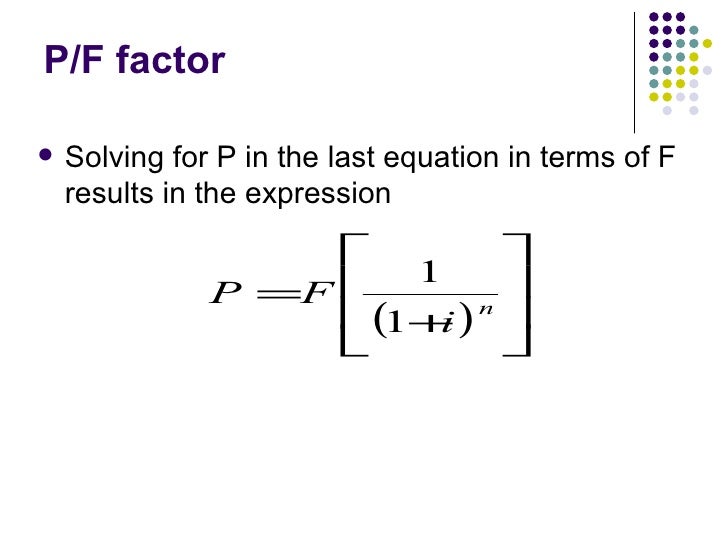

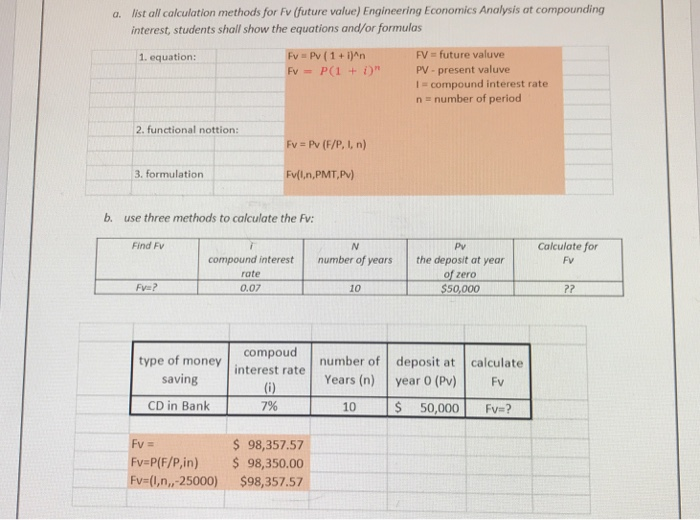

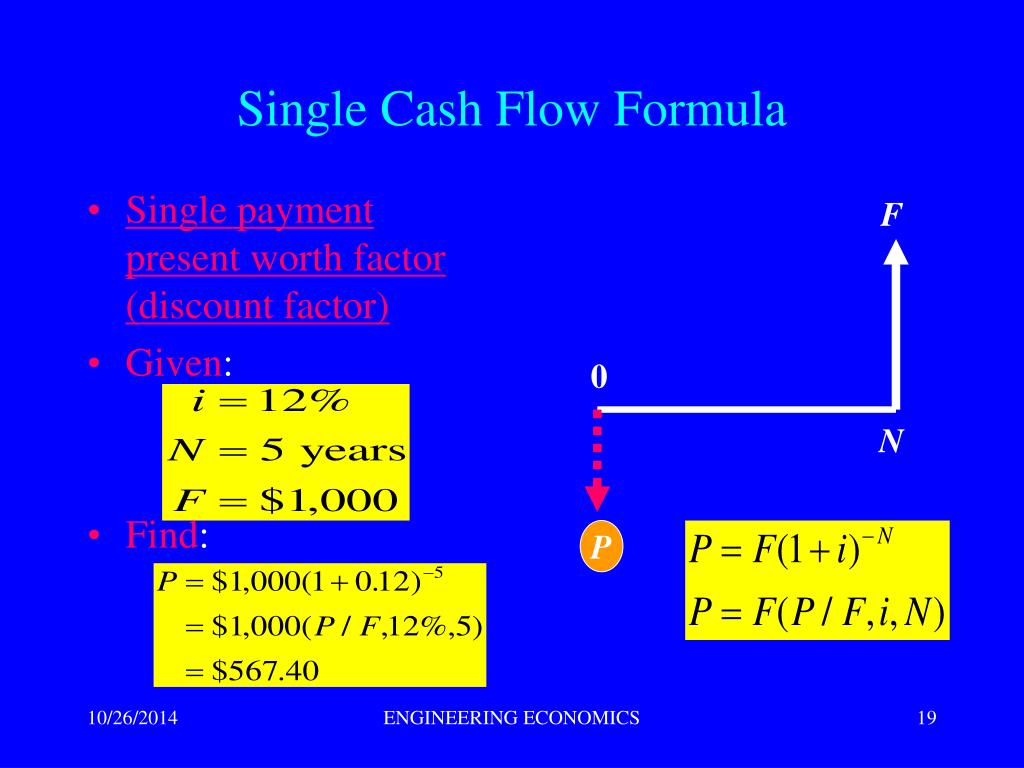

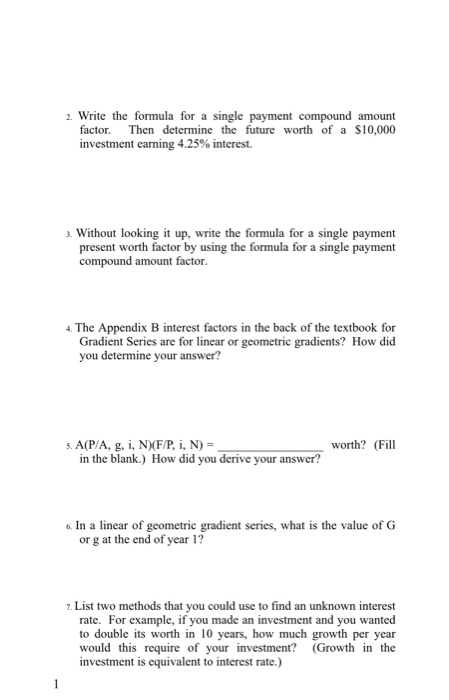

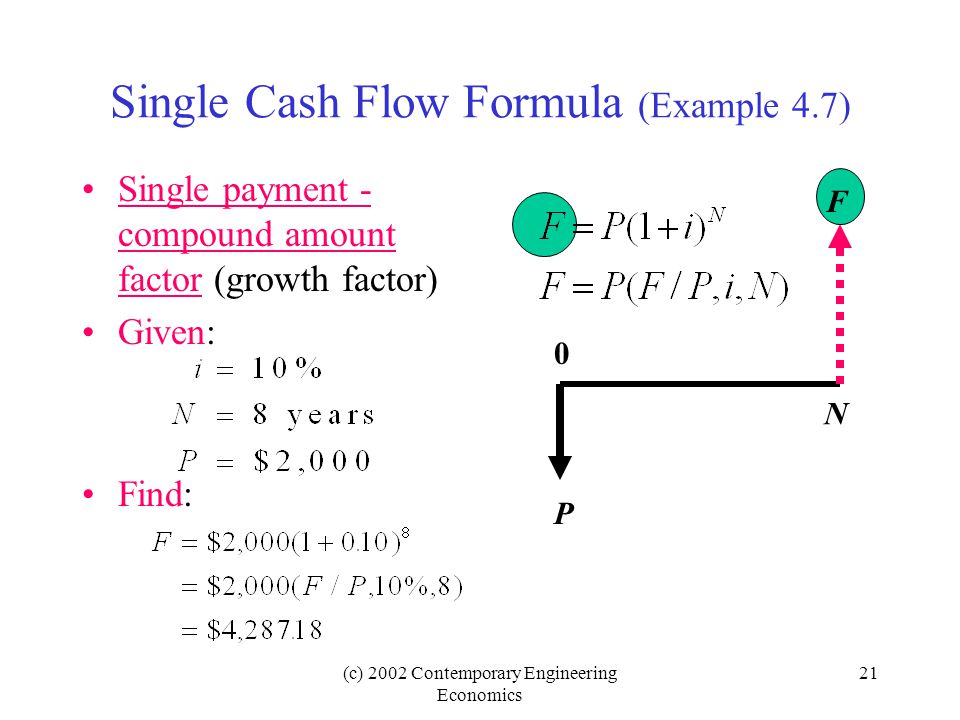

Pf formula economics. A formula is needed to provide a quantifiable comparison between an amount today and an amount at a future time in terms of its present day value. Using a block function to find the present worth or internal rate of return for a table of cash flows. What is the calculator about.

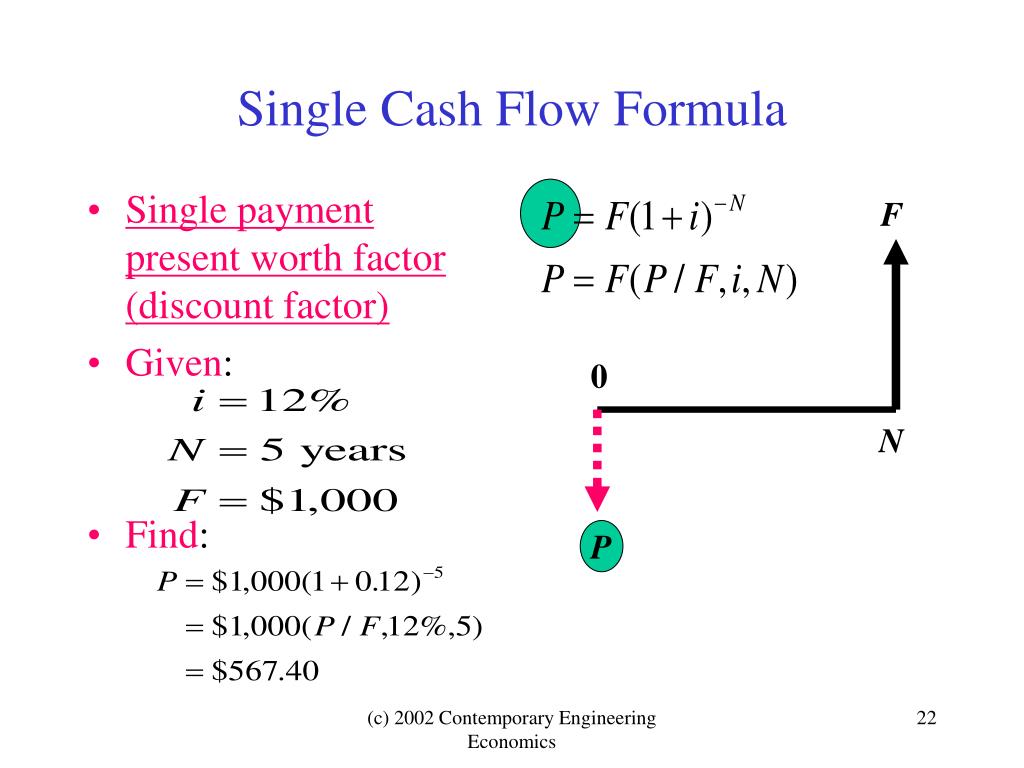

An payment of 5000 is received after 7 years. I discount rate per period. F single future payment.

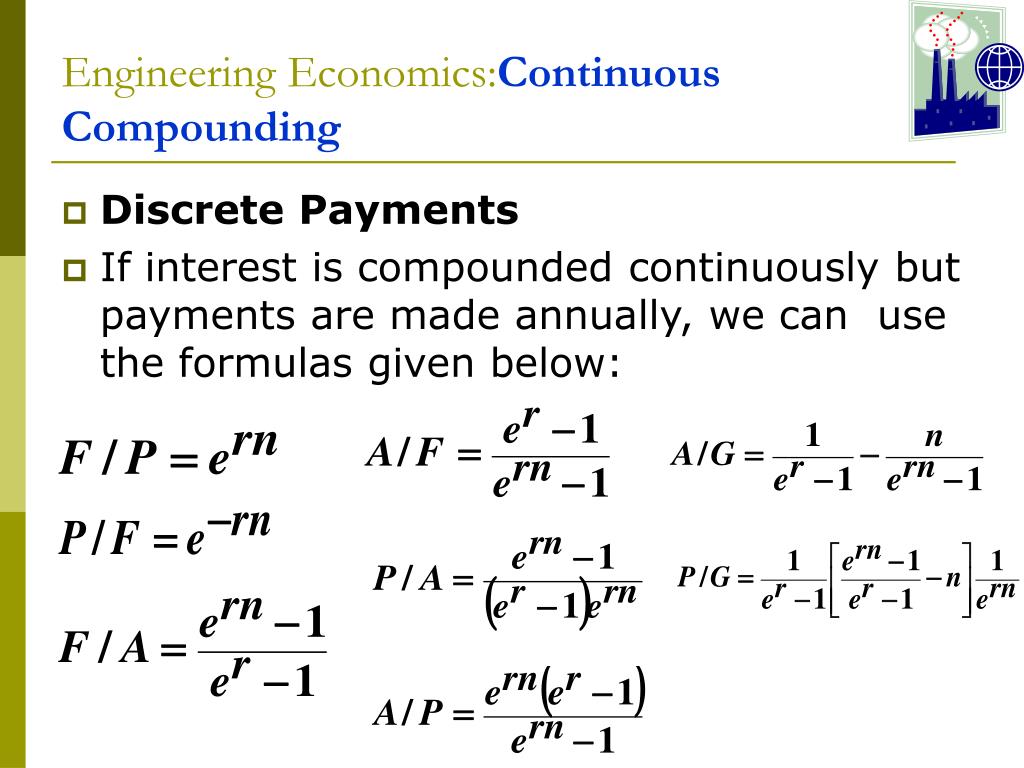

G uniform rate of cash flow increase or decrease from. The essential idea behind engineering economics is that money generates money. After a year you have 1020 instead of 1000.

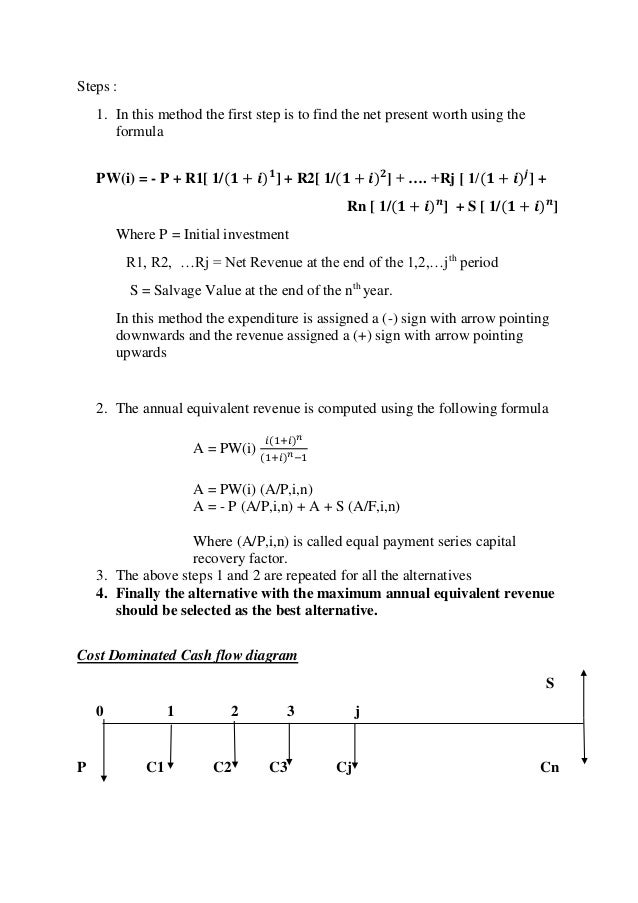

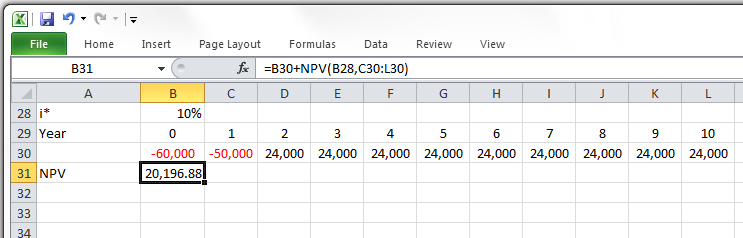

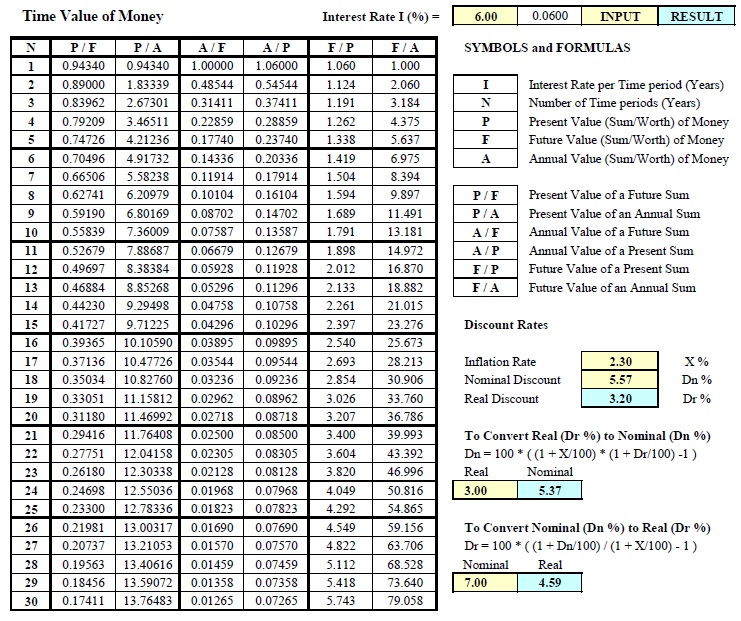

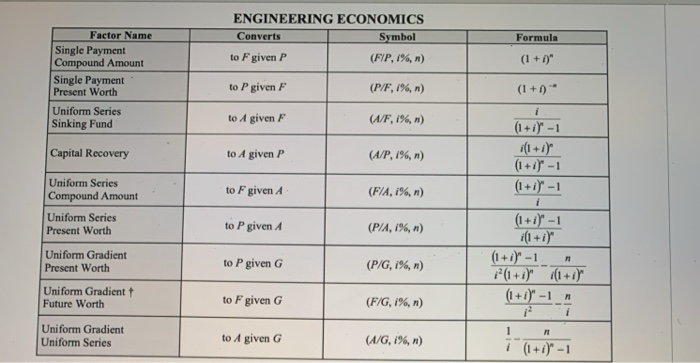

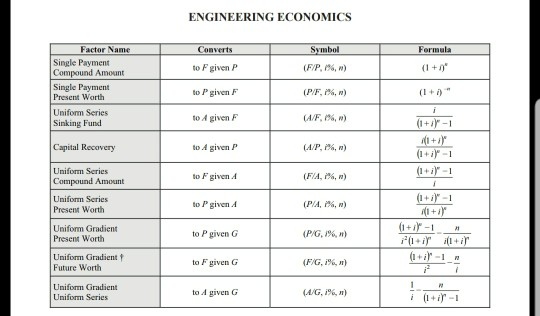

Constructing tables of cash flows. 116 engineering economics factor table i 050 n pf pa pg fp fa ap af ag 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 40 50 60 100. Uniform series sinking fund.

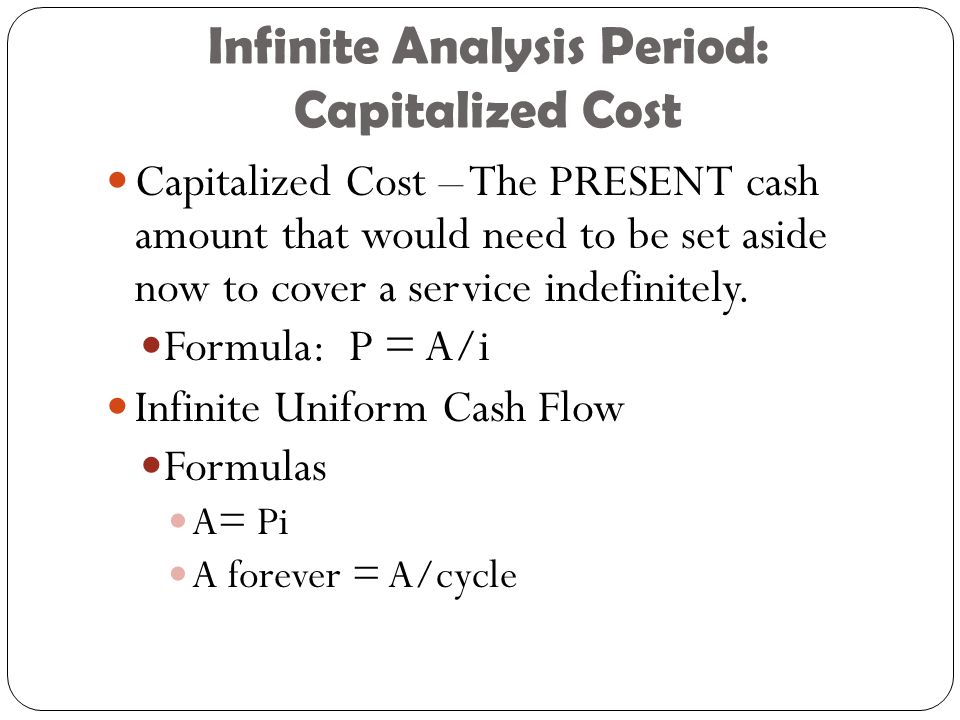

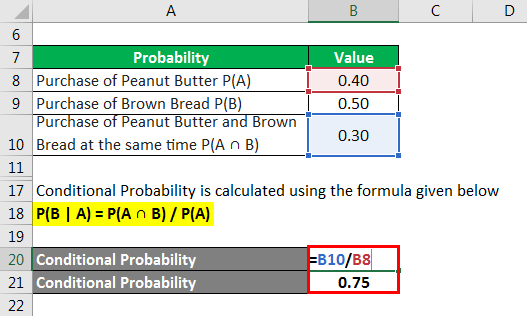

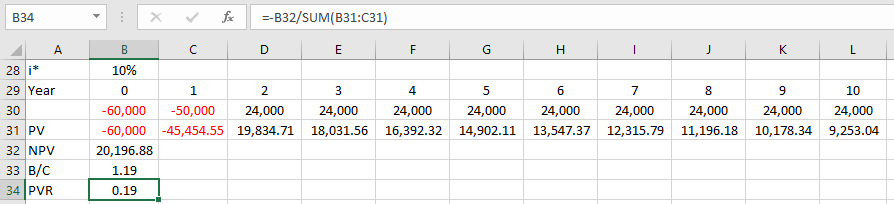

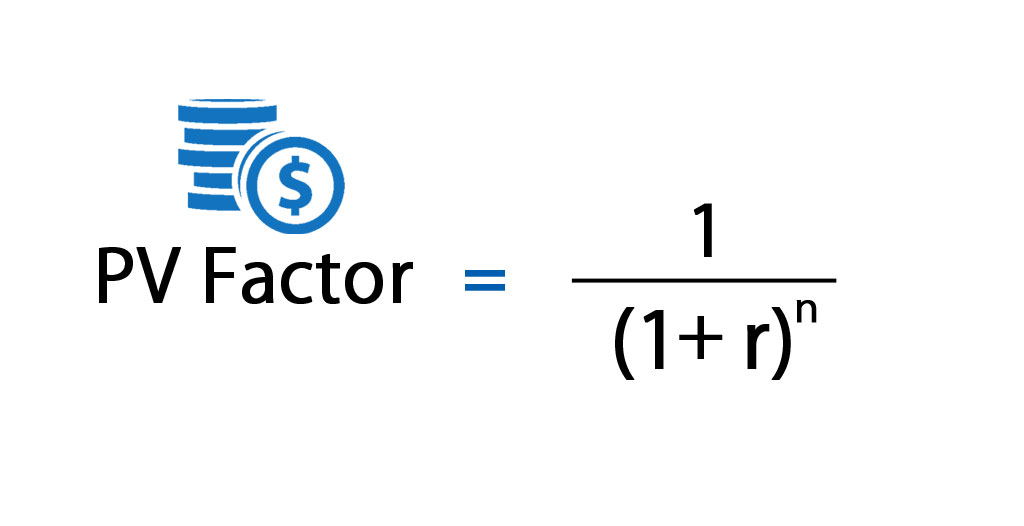

P present value. Making graphs for analysis and presentations. Use of present value formula the present value formula has a broad range of uses and may be applied to various areas of finance including corporate finance banking finance and investment finance.

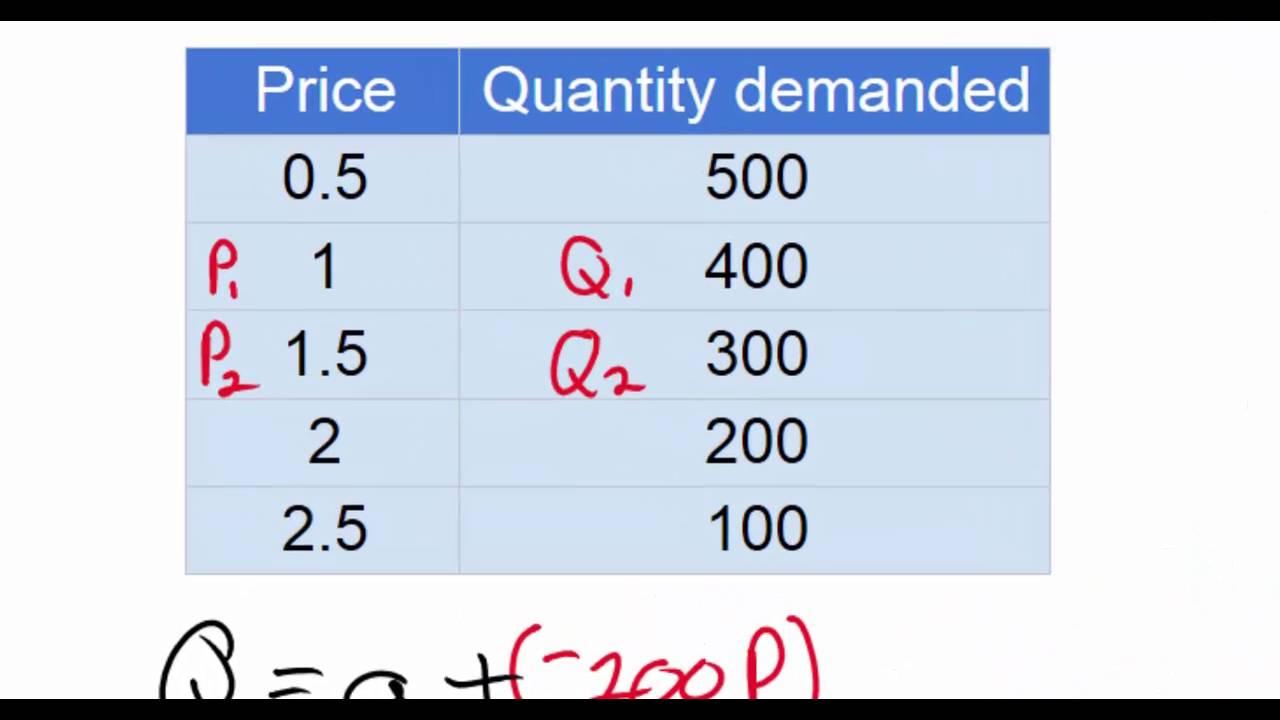

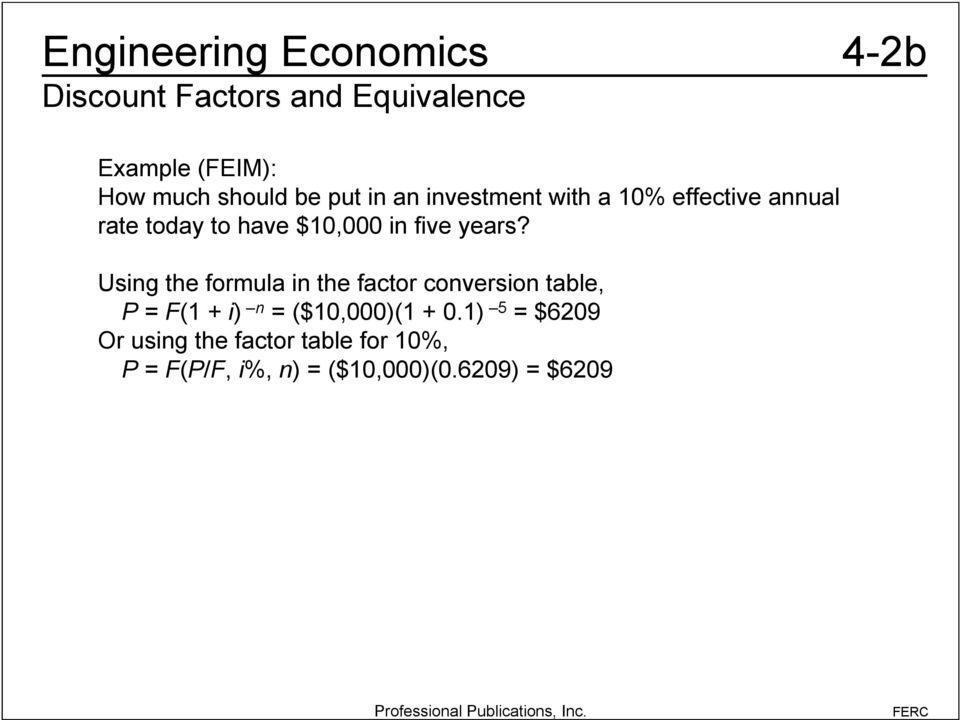

P a present sum of money. Using annuity functions to calculate p f a n or i. Calculate the present worth or value of this payment with dicount rate 5.

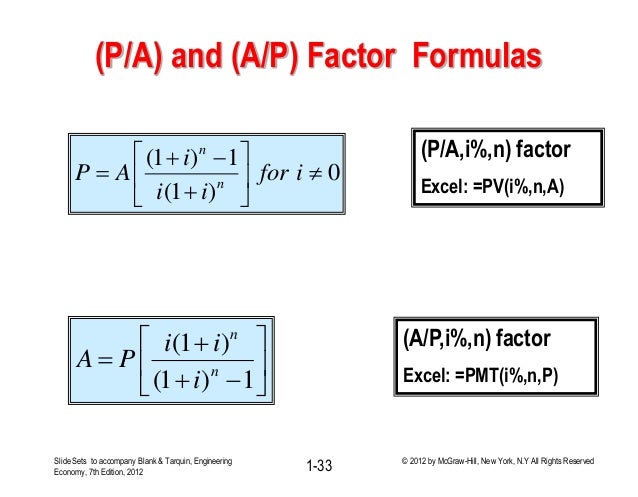

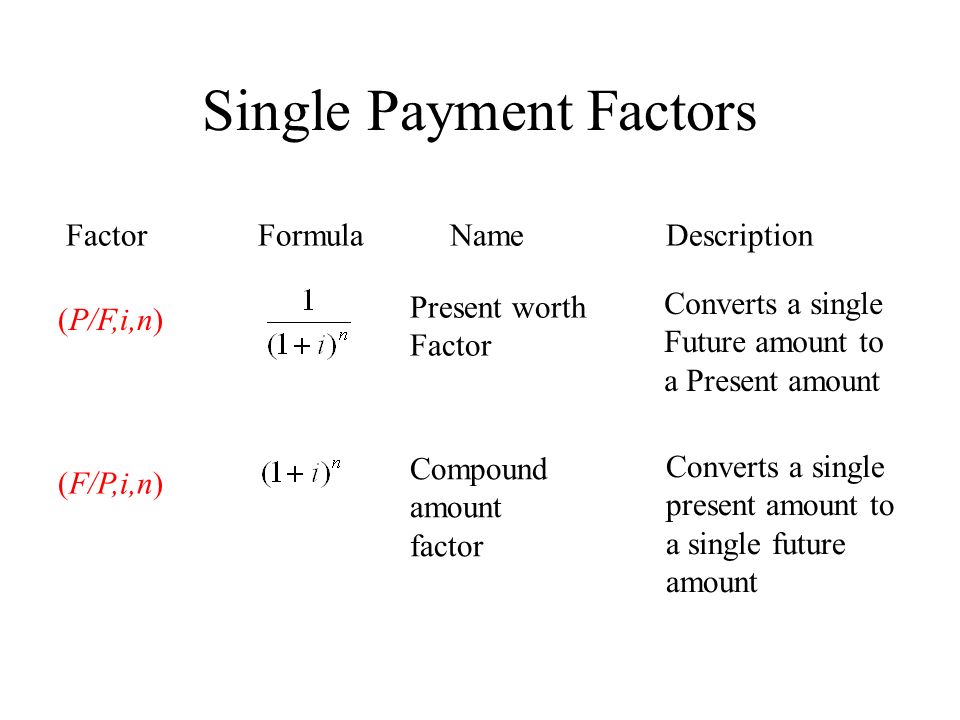

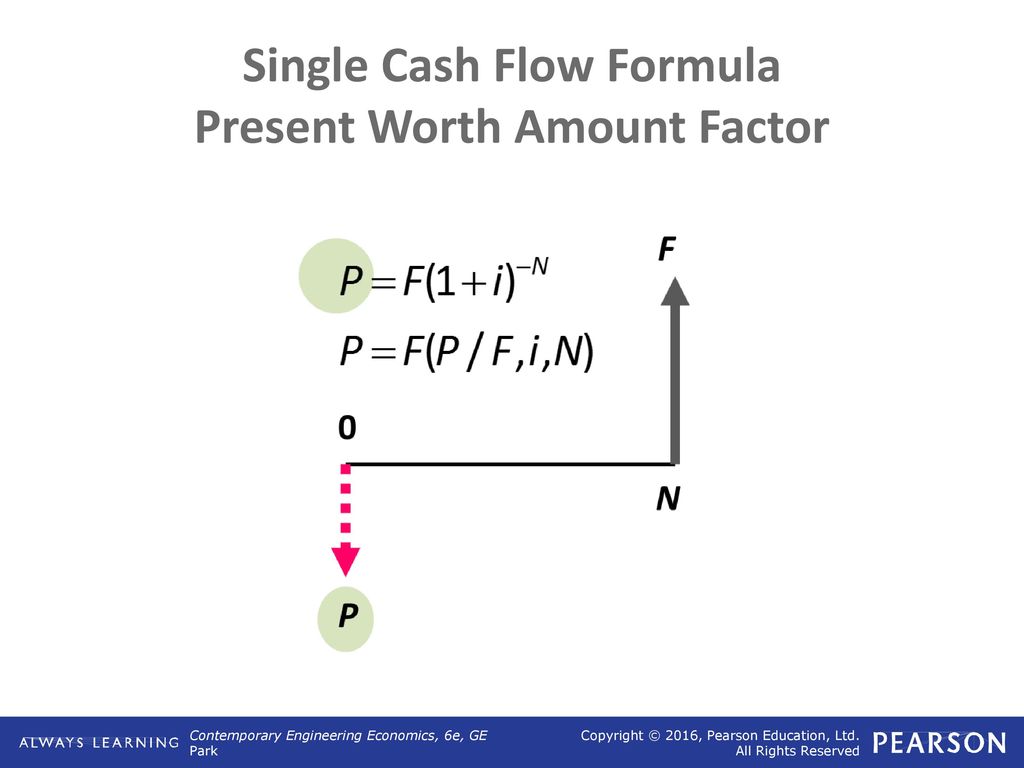

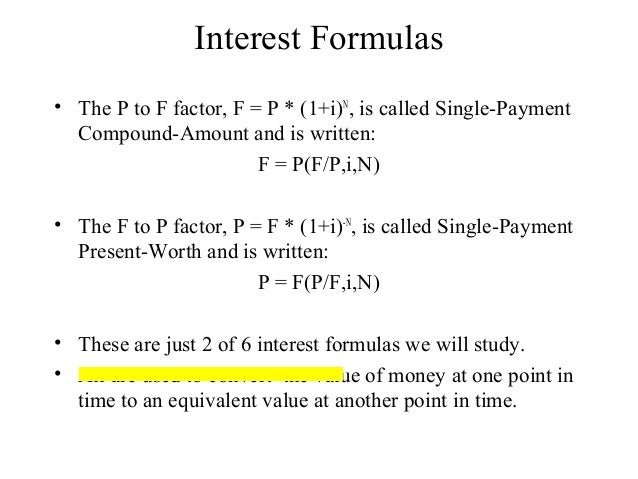

P f 1 i n 2 where. A uniform amount per interest period i interest rate per interest period n number of compounding period or the expected life of asset. Ap i n it is converting to a given.

A an end of period cash receipt or disbursement in a uniform series continuing for n periods. P present worth value or amount. Single payment compound amount.

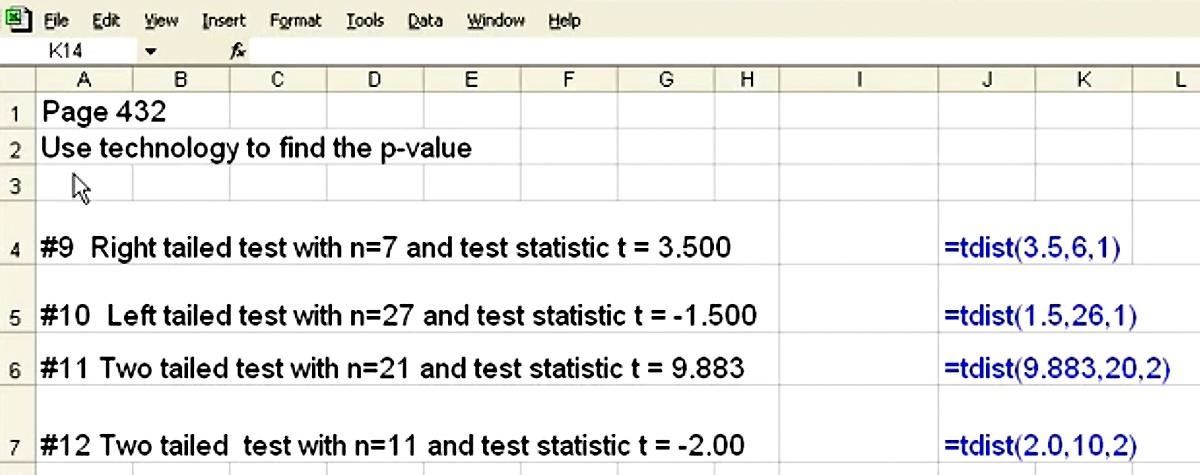

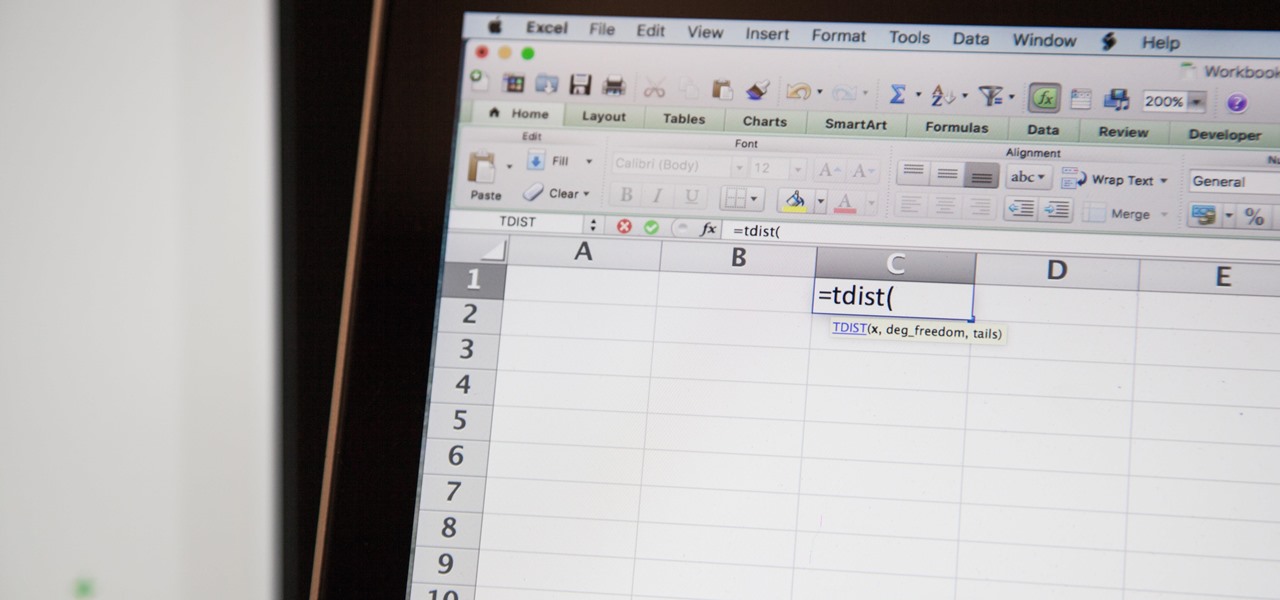

Uniform series present worth. The employees provident fund epf calculator will help you to calculate the amount of money you will accumulate on retirement. In economic analysis spreadsheets may be helpful for a number of purposes.

As a percentage enter the period. N number of interest periods. N number of periods.

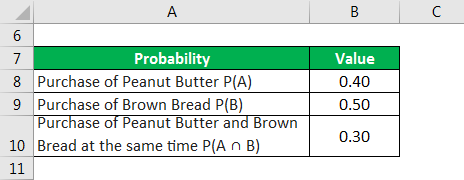

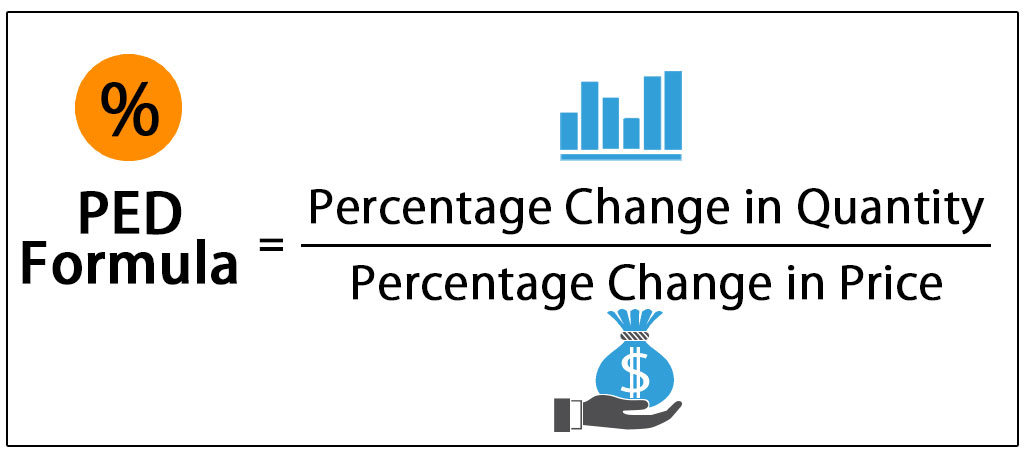

The discount rate can be calculated. Learn what economic profit is and how its different from standard accounting profit in this lesson. Choose one formula from the following list.

In years enter a value for fpaor g here. Viii formulas compound interest i interest rate per interest period. Single payment present worth.

Your present age and the age when you wish to retire. Find out the formula for calculating economic profit and why its possible to have a positive. F a future sum of money.

You cannot compare 1000 today to 1000 a year from now without adjusting for the investment potential. G uniform period by period increase or decrease in cash receipts or disbursements. How to use it to arrive at the retirement corpus you need to enter few details such as.

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

/JointProbabilityDefinition2-fb8b207be3164845b0d8706fe9c73b01.png)

:max_bytes(150000):strip_icc()/calculating-equilibrium-1-56a27d965f9b58b7d0cb4207-5c2a44fa46e0fb00010dcd0a.jpg)