Ke Formula Finance

Https Encrypted Tbn0 Gstatic Com Images Q Tbn 3aand9gcttubm6y4ovbwj1ploaf9pjryh6o0fspbc1vuvoadtz1dfn5qy6 Usqp Cau

encrypted-tbn0.gstatic.com

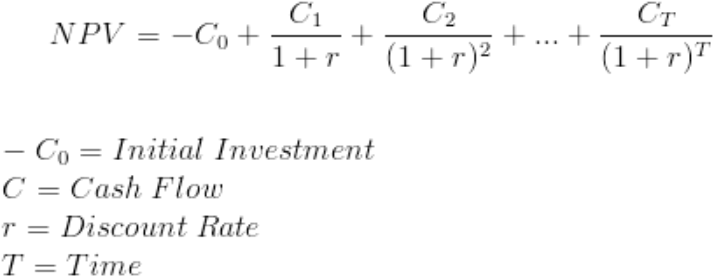

Also experiment with other financial calculators or explore hundreds of other calculators addressing math fitness health and many more.

Ke formula finance. G future dividend growth. Formula to calculate total equity of a company. Its the responsibility of the company.

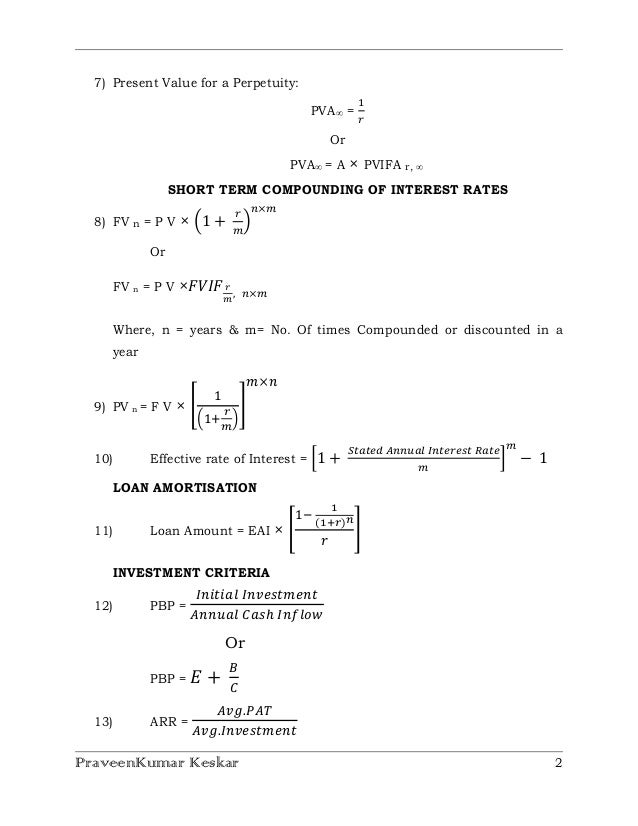

Excel formulas pdf is a list of most useful or extensively used excel formulas in day to day working life with excel. The excel functions covered here are. Future value fv compounding periods n interest rate iy periodic payment pmt present value pv or starting principal.

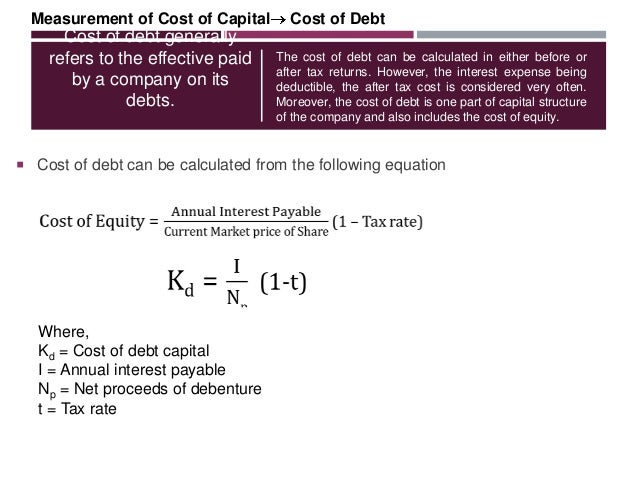

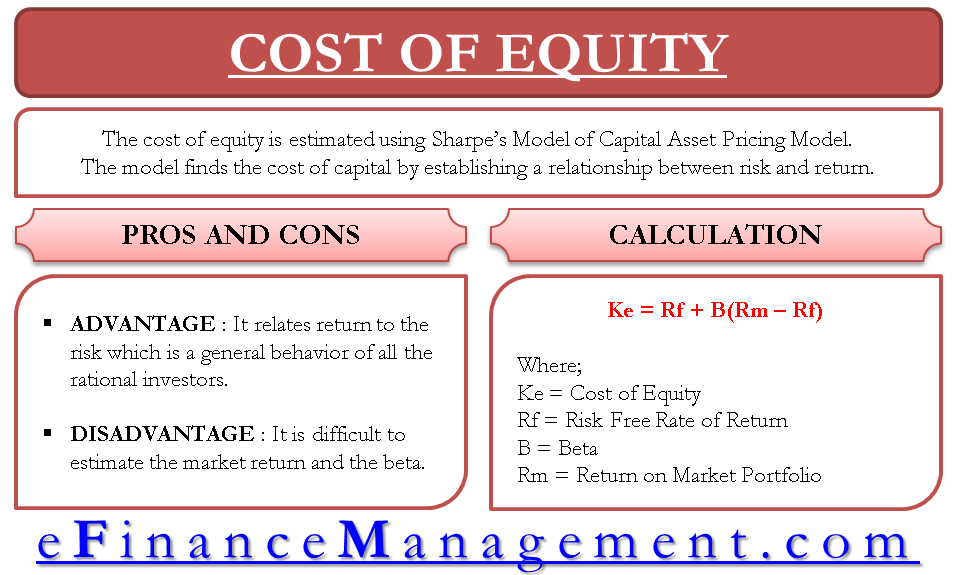

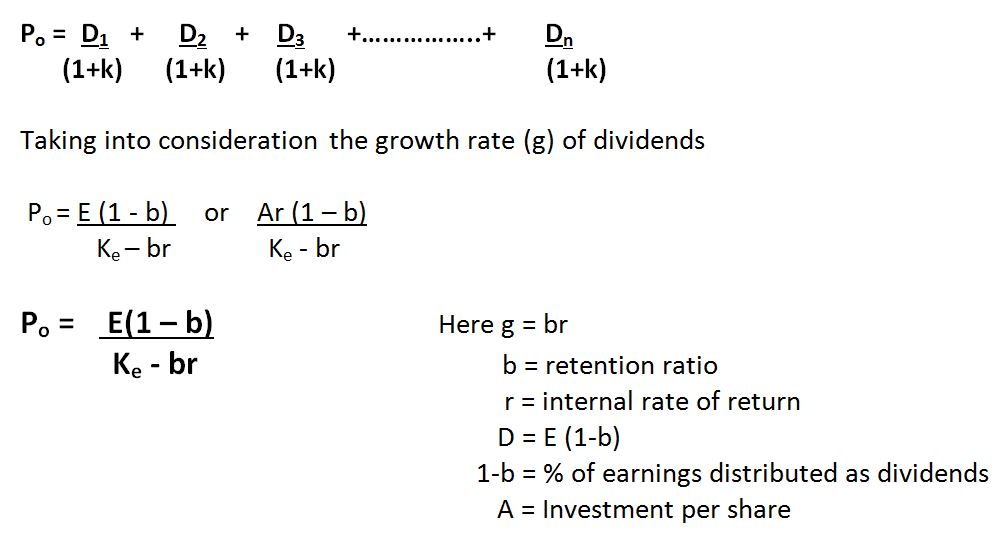

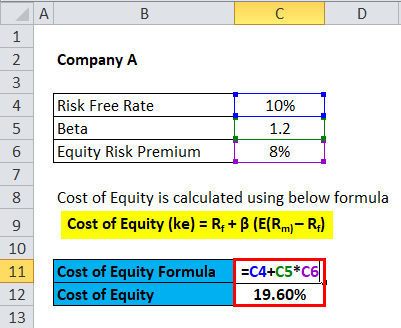

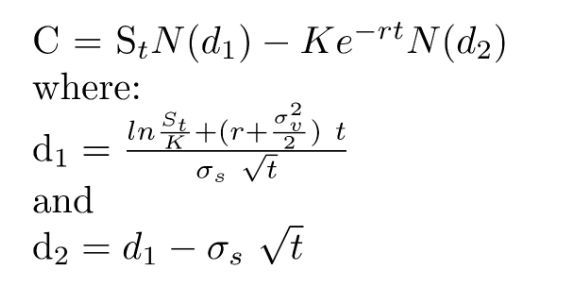

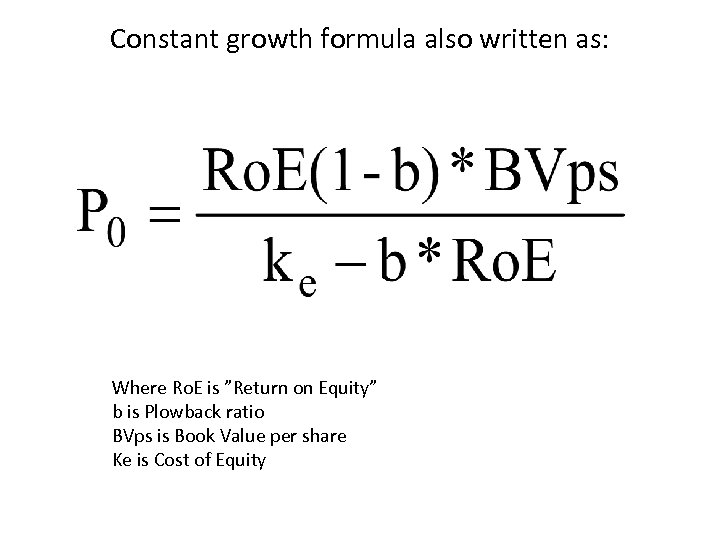

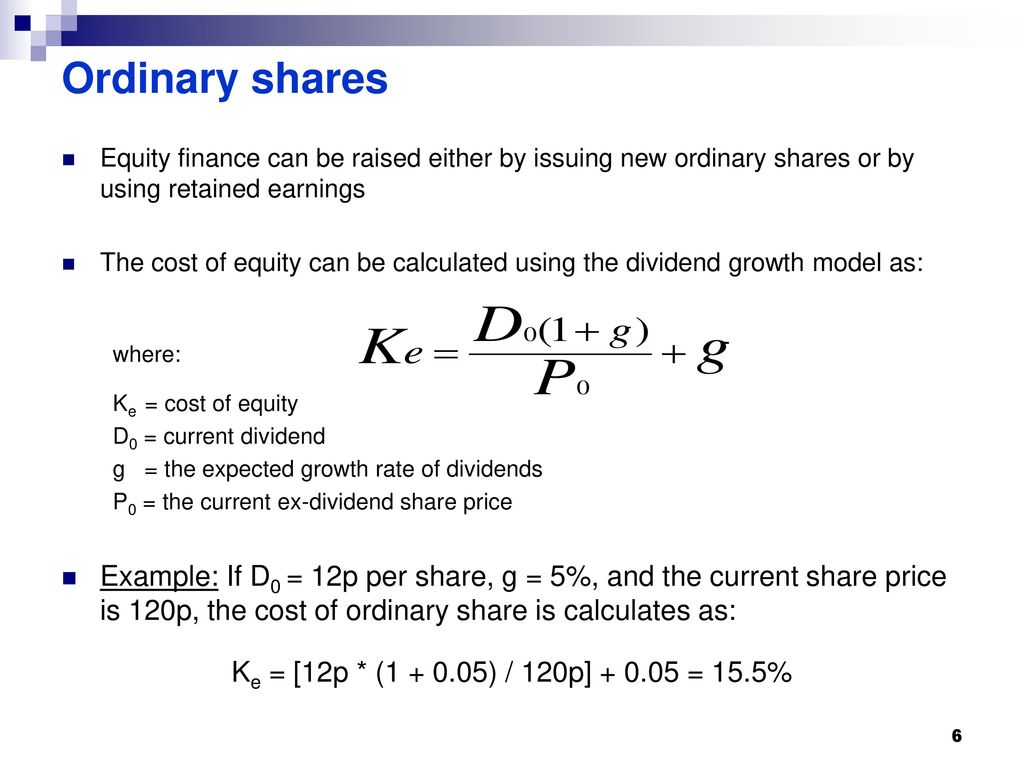

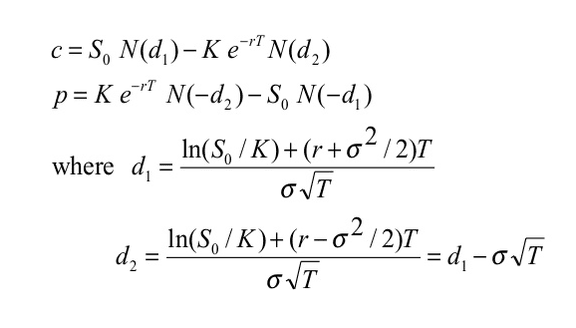

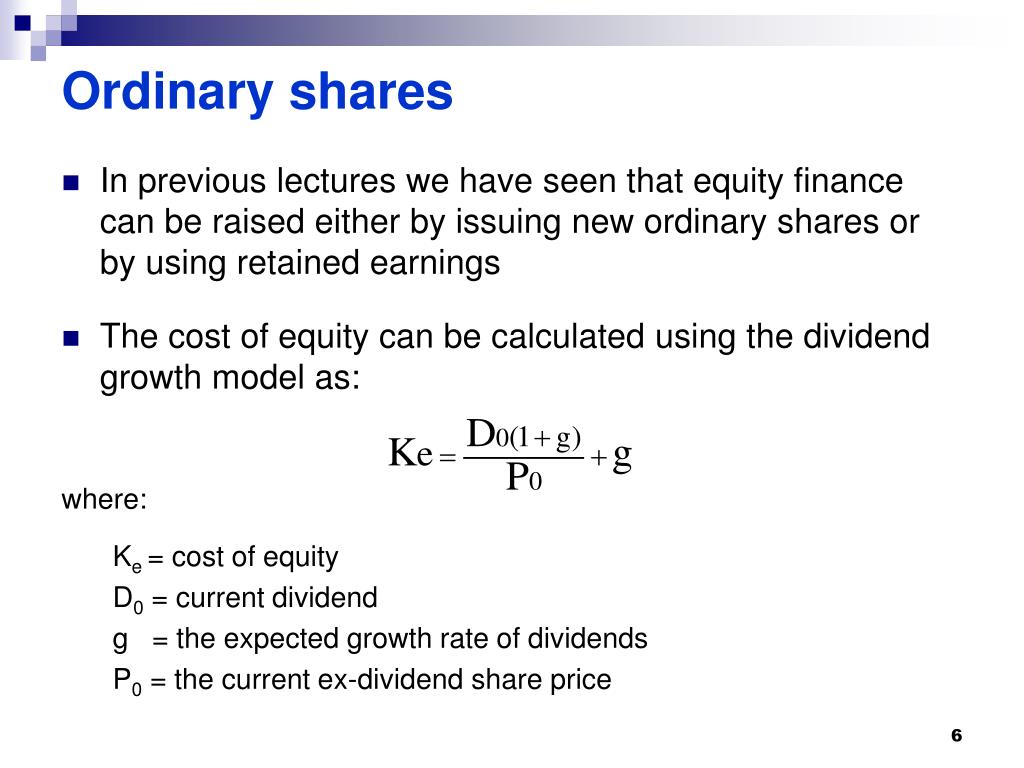

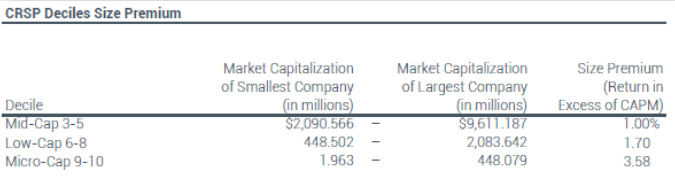

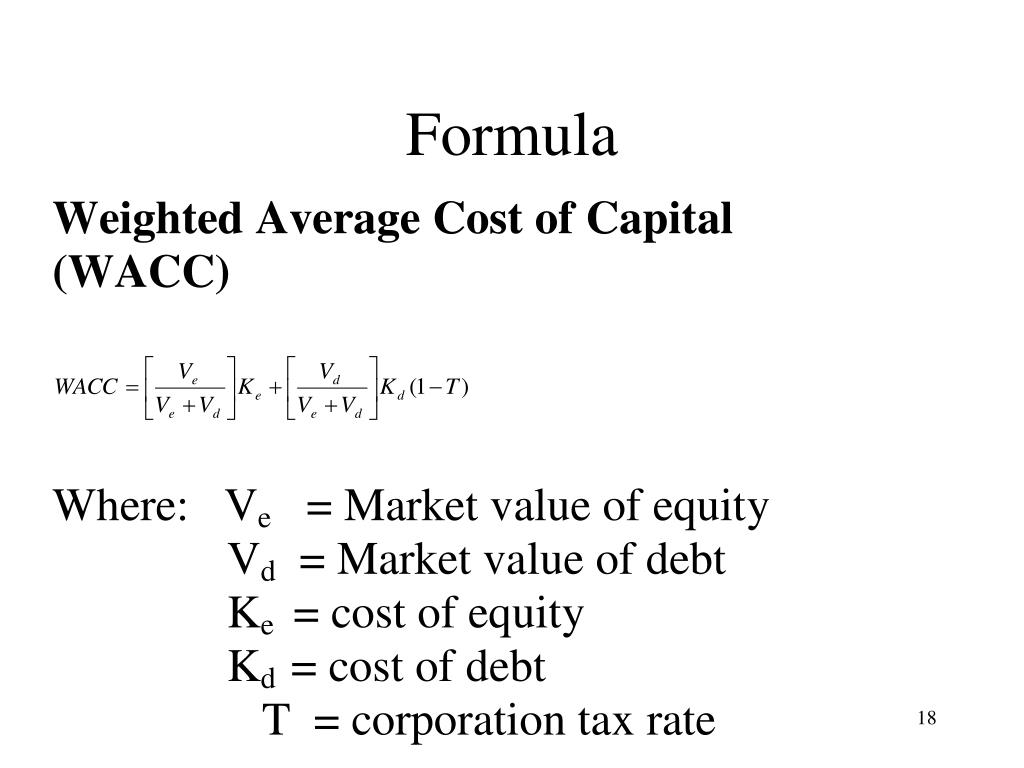

Ke cost of equity d1p0g. The two formulas you referred to are. This formula could also be written as d0 x 1g p0 g.

Discover the top 10 types knows that nested if formulas can be a nightmare. 3 statement model dcf model ma model lbo model budget model. Here total assets refers to assets present at the particular point and total liabilities means liability during the same period of time.

Equity formula states that the total value of the equity of the company is equal to the sum of the total assets minus the sum of the total liabilities. 2016 as well as 2019. Assumes dividends are paid and the company has a share price.

The ratio examines the consistency of an equitys return over time. If combined with and or. It is the rate which the company needs to generate to allure the investors to invest in their stock at the market price.

The ke is not exactly what we refer to. Vlookup index match rank average small large lookup round countifs sumifs find date and many more. P0 share price.

Assumes dividend growth can be estimated. P0 stands for price of share today g at the end is the growth rate. Ke d1p0 g.

D stands for divideds 1 is representing the growth in divided. Cost of equity formula in excel with excel template here we will do the example of the cost of equity formula in excel. Ifandc2c4c2c5c6c7 anyone whos spent a great deal of time doing various types of financial models types of financial models the most common types of financial models include.

D0 dividend paid. Corporate finance accounting. Ke d0 1gp0 g.

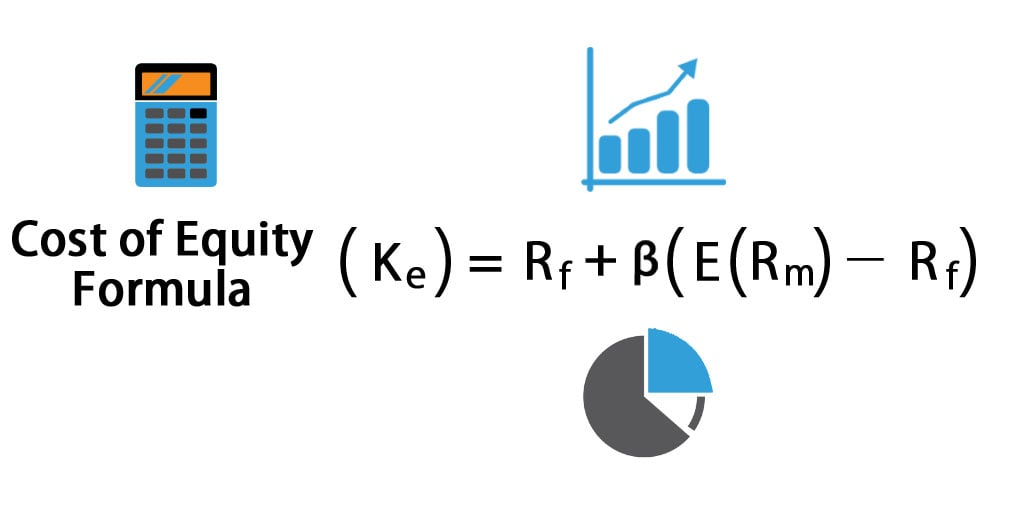

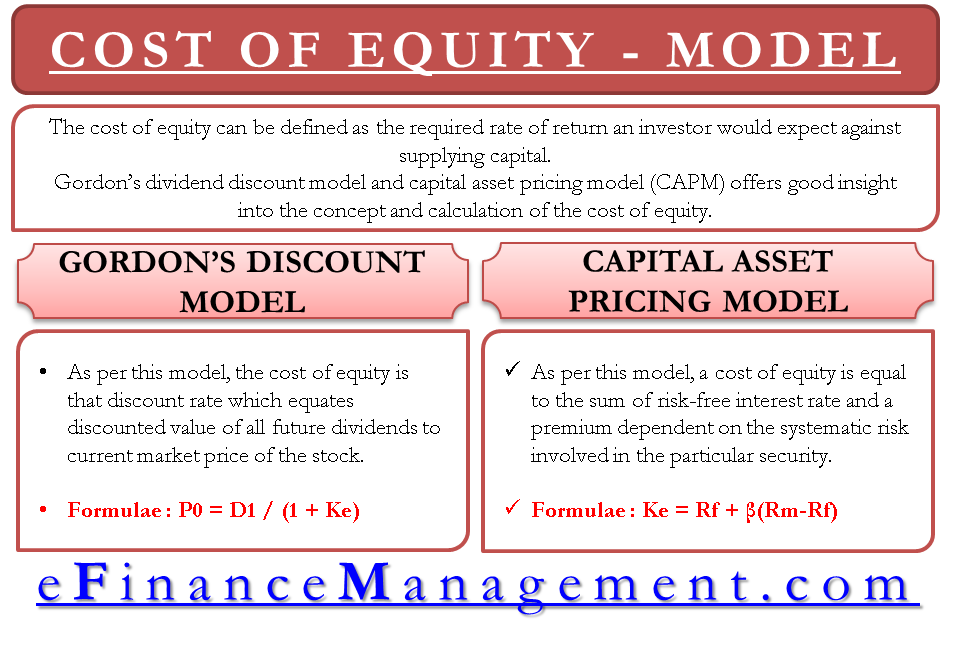

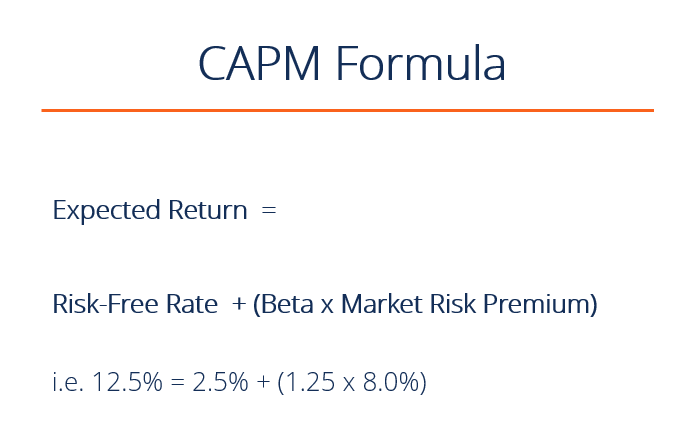

You need to provide the three inputs ie risk free rate beta of stock and equity risk premium. Sorry for jumping in but wanted to privde you a quick answer. Thats why the ke is also referred to as the required rate of return.

Ke the cost of equity shareholders required rate of return d1 dividend to be paid at the end of year 1. A ratio that is used in the performance evaluation of an equity relative to its risk. You can easily calculate the cost of equity using formula in the template provided.

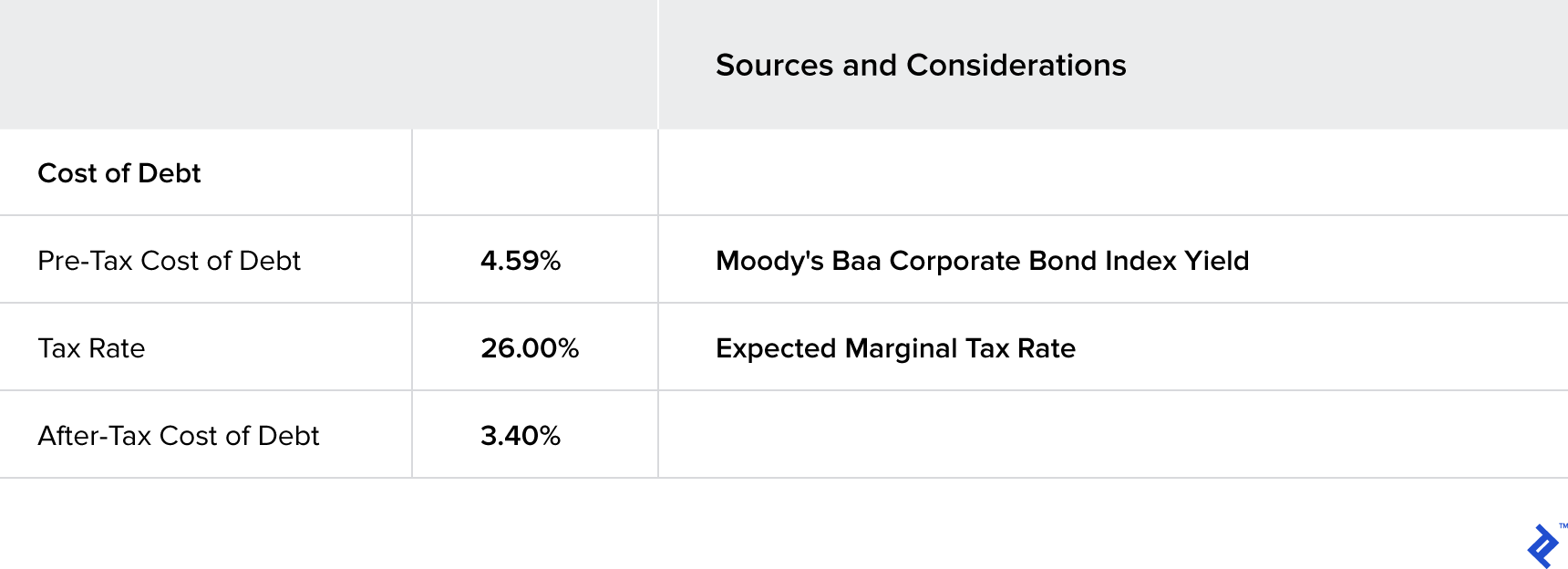

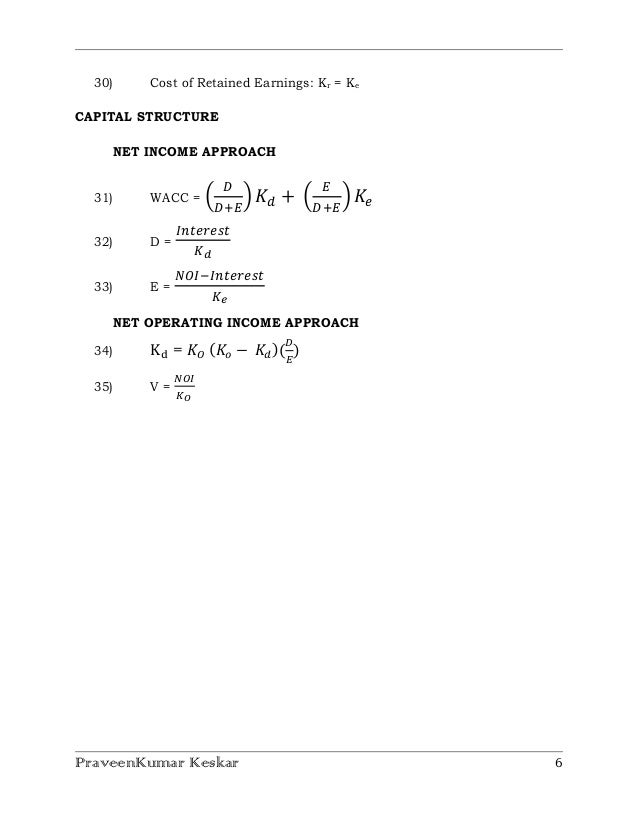

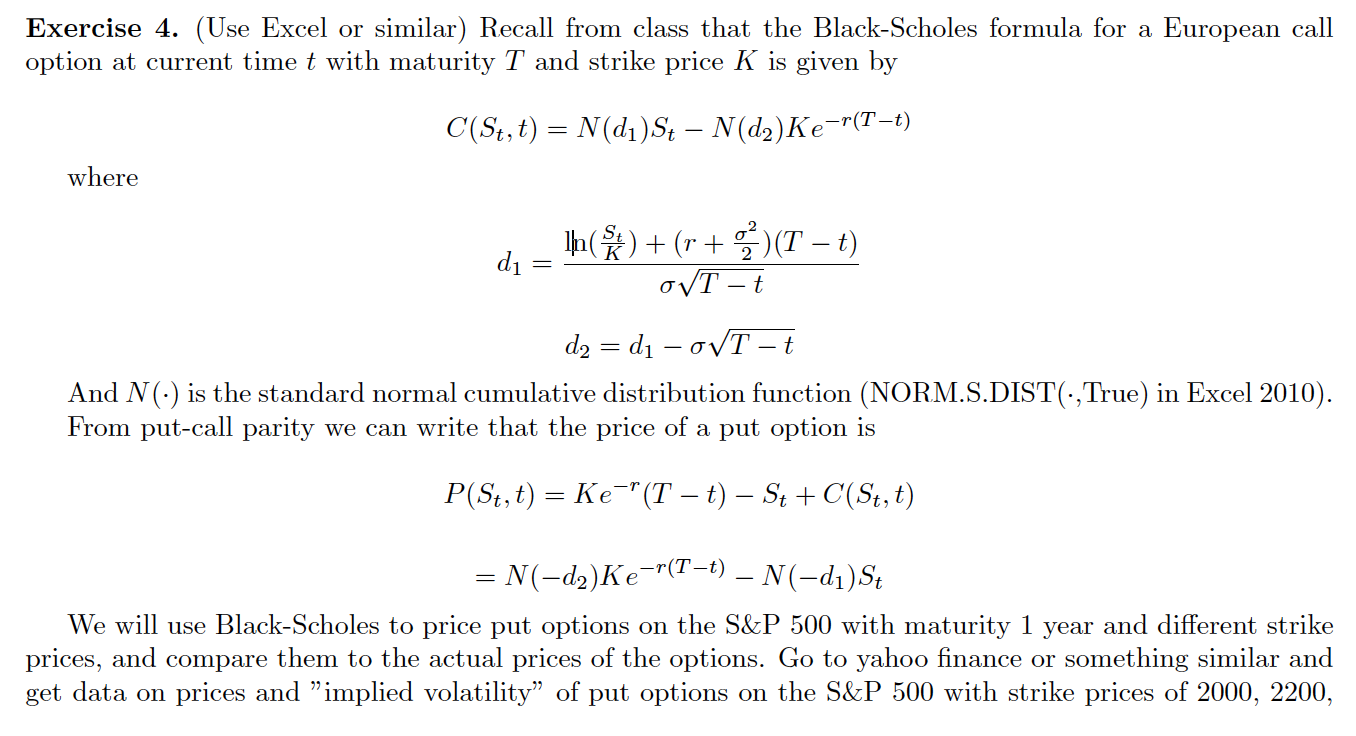

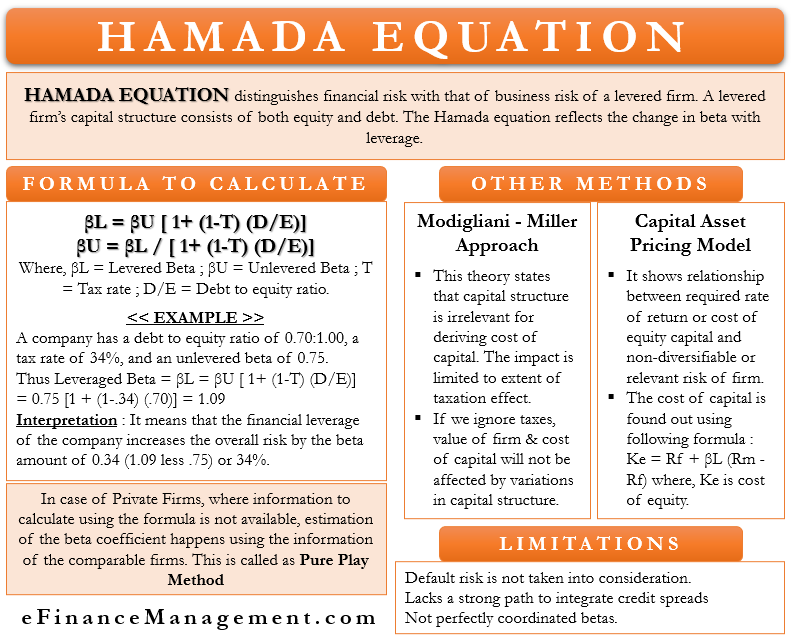

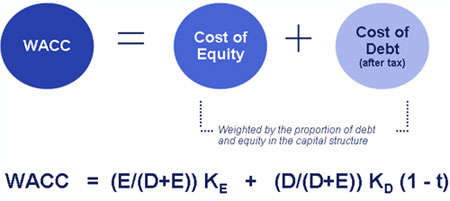

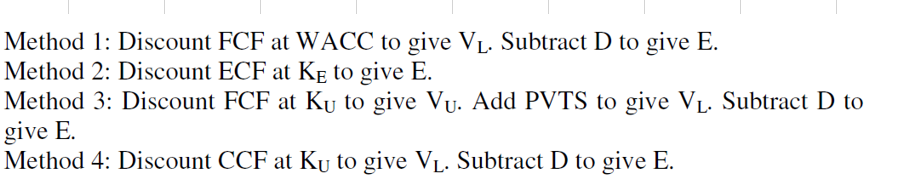

The data for the ratio is derived. It is very easy and simple. The traditional formula for the cost of equity is the dividend capitalization model and the capital asset pricing model capm.

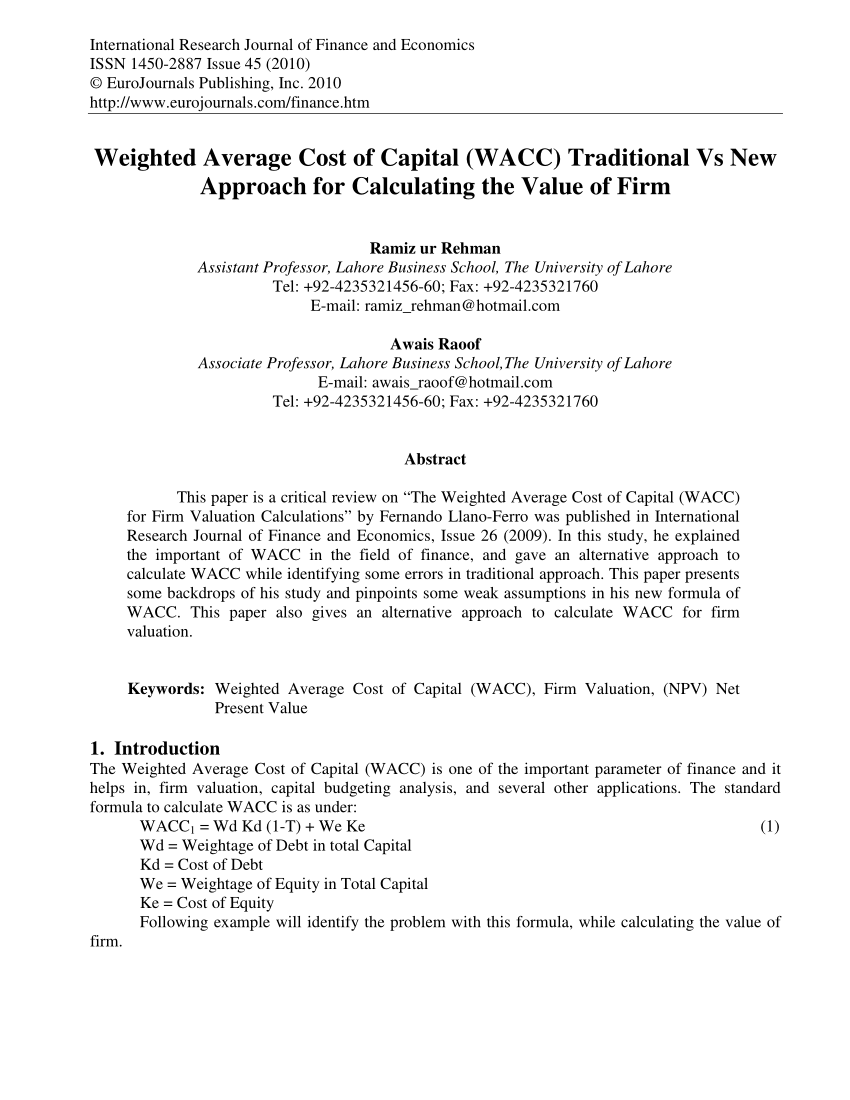

Pdf Weighted Average Cost Of Capital Wacc Traditional Vs New Approach For Calculating The Value Of Firm

www.researchgate.net

Market Value Calculation And The Solution Of Circularity Between Value And The Weighted Average Cost Of Capital Wacc

www.scielo.br

Does Anyone Know How To Calculate The Weighted Average Cost Of Capital Using The Dividend Discount Model Quora

www.quora.com

Https Www Studocu Com Sg Document Qatar University Corporate Finance Lecture Notes Formula Lecture Notes 1 10 7580005 View

:max_bytes(150000):strip_icc()/pbratio-38e5cff99f884633a152df2a61dcb31e.jpg)

:max_bytes(150000):strip_icc()/Formula-WACC-6d76647d4d5143ef95f8b568da4856a7.png)

/CAPM2-cc8df29f4d814b1597d33eb7742c9243.jpg)