Does Ford F150 Qualify For Bonus Depreciation

2016 Ford F 150 Crew Cab King Ranch 4wd Prices Values F 150 Crew Cab King Ranch 4wd Price Specs Nadaguides

www.nadaguides.com

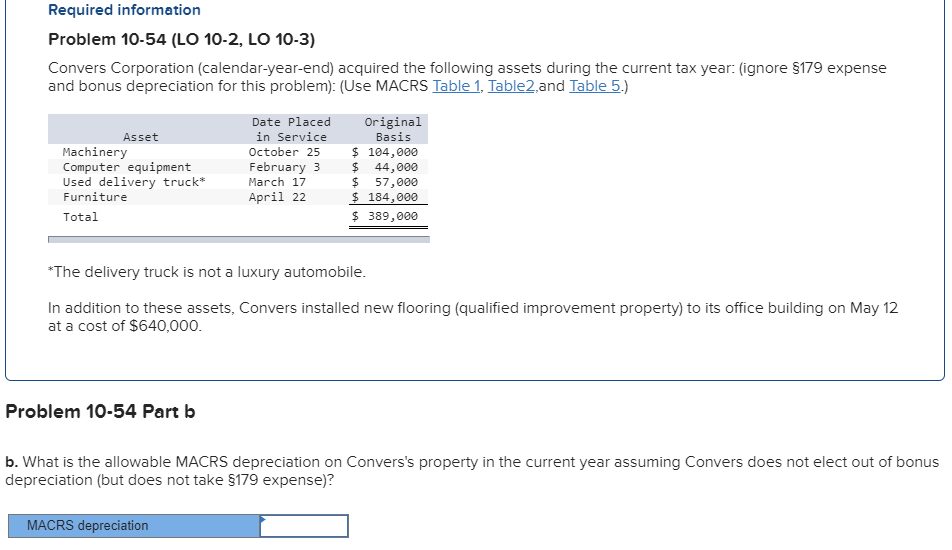

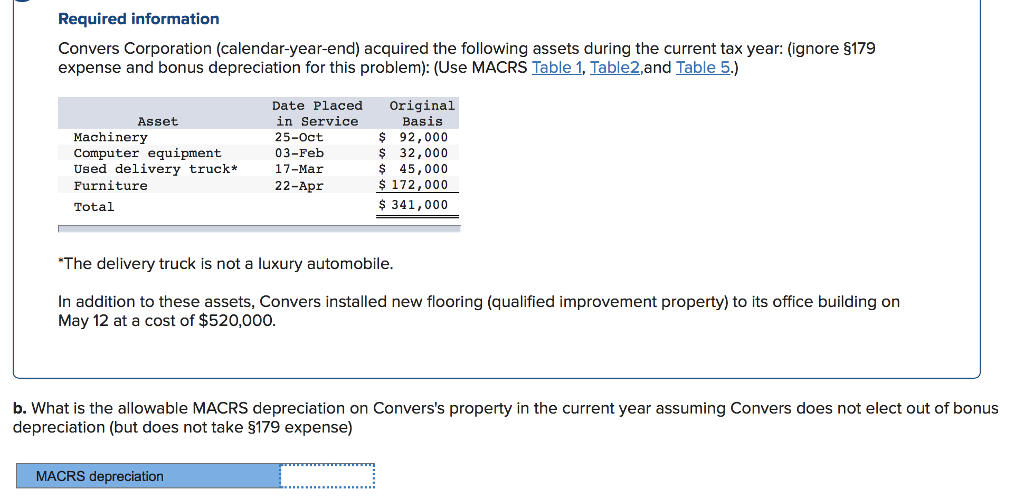

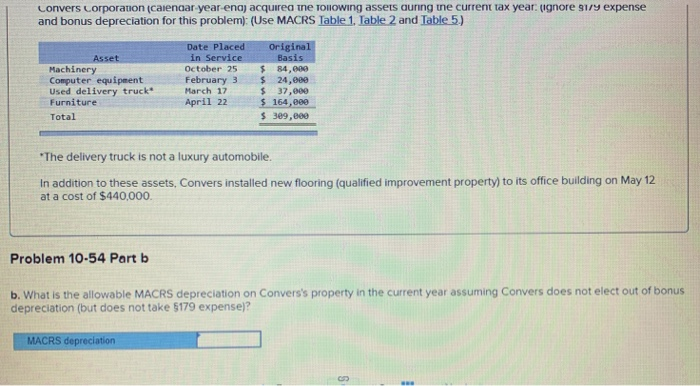

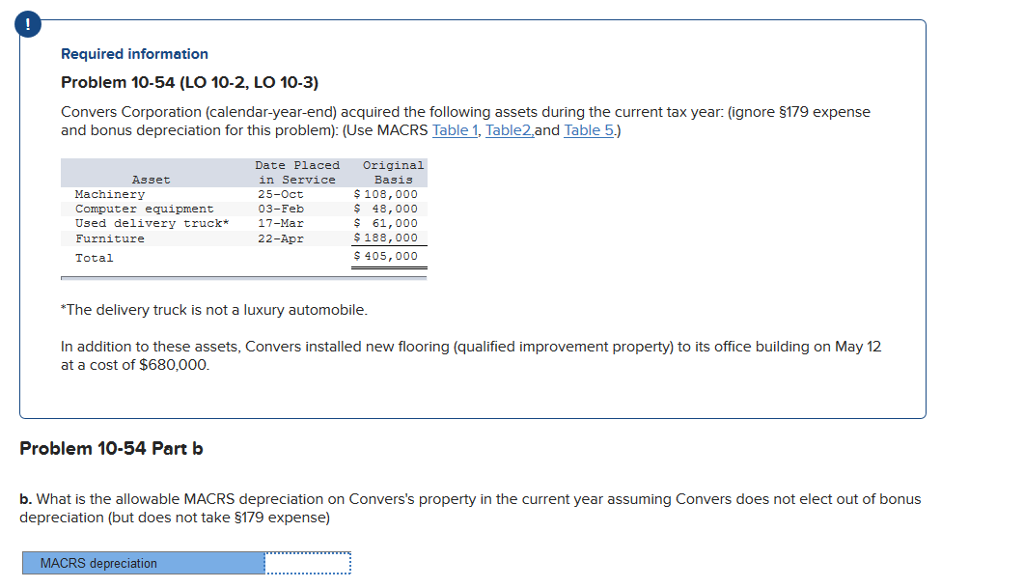

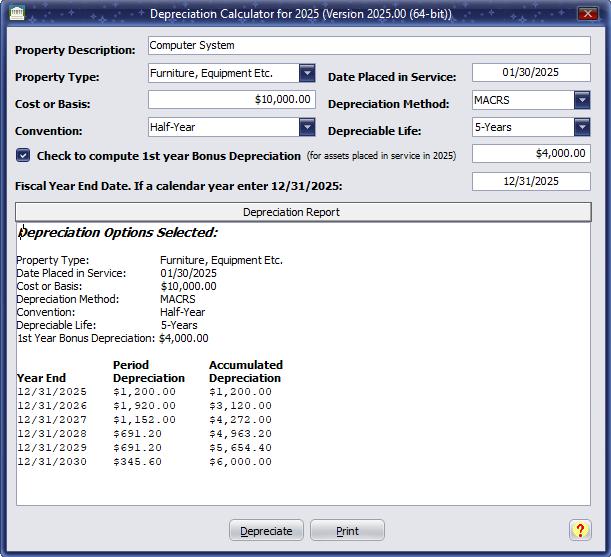

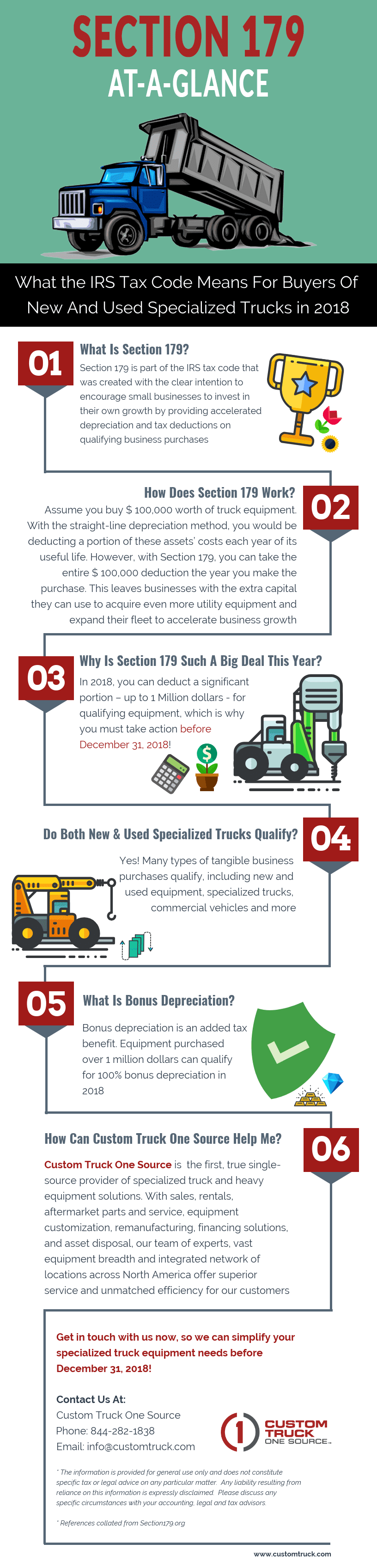

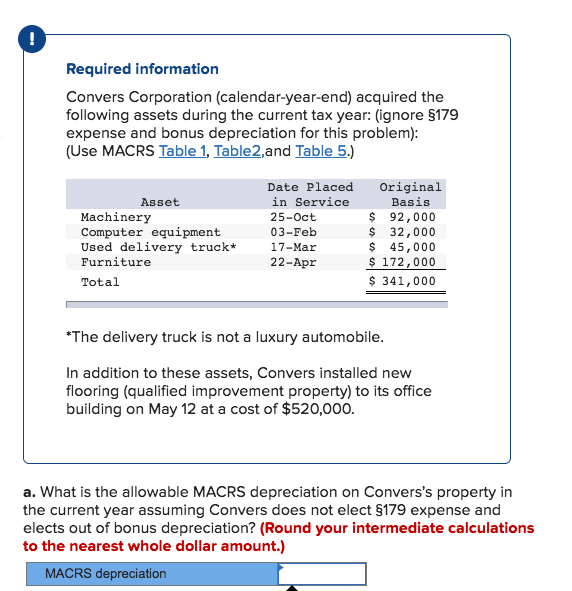

If your business does not qualify for the section 179 deduction you can take advantage of another tax break bonus depreciation.

Does ford f150 qualify for bonus depreciation. Under prior law the first year bonus depreciation rate for 2017 was only 50. This lets you deduct 50 of the cost of the assets in the year that it has been purchased. The 2019 ford f 150 is our top pick for the best model year value for the f 150.

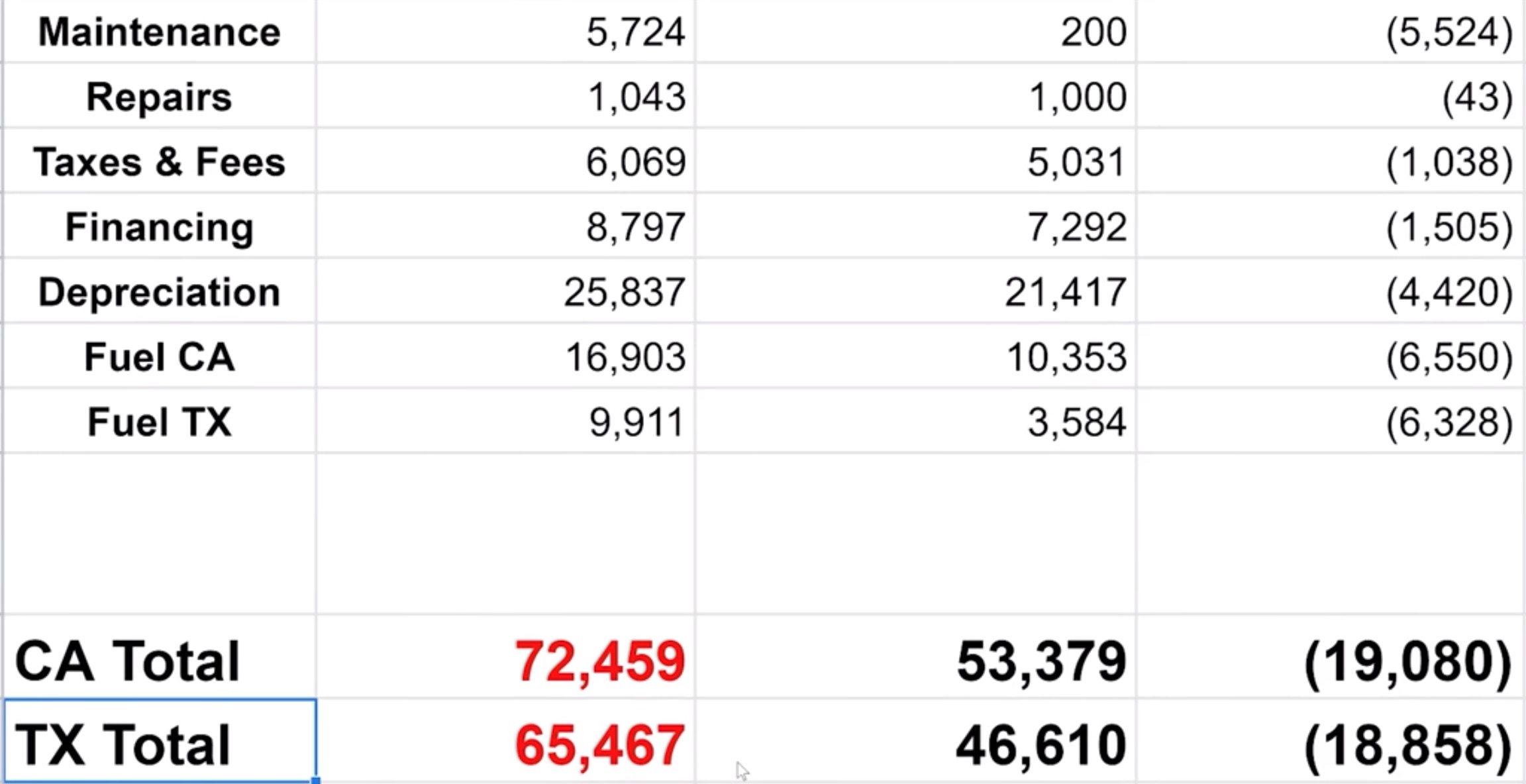

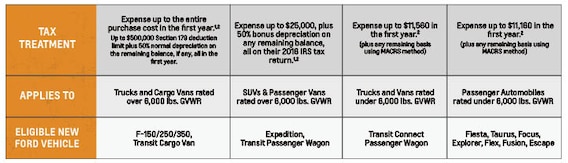

Depreciation limits will be reduced for personal use if the vehicle is used for business less than 100 of the time. 179 expensing if used over 50 for business. By entering a few details such as price vehicle age and usage and time of your ownership we use our depreciation models to estimate the future value of the car.

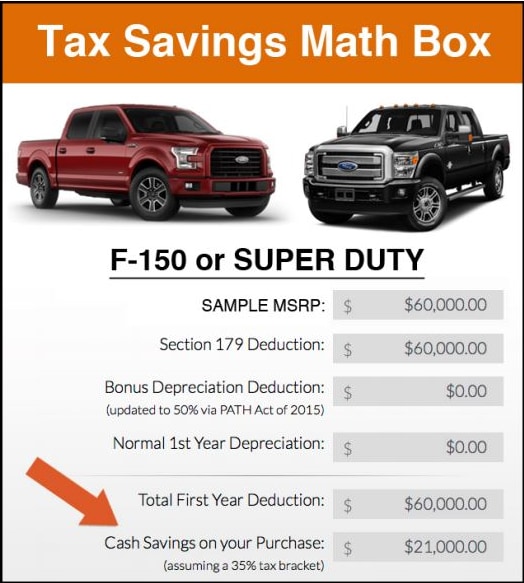

And a bed length of at least six feet ie ford f150f250f350 qualify for the maximum firstyear depreciation deduction of up to the full purchase price. However if a heavy vehicle is used 50 or less for business purposes you must depreciate the business use percentage of the vehicles cost over a six year period. If you buy a 100000 truck that means that 50000 can be immediately expensed under bonus depreciation in the first year so long as it was solely used for business.

Use this depreciation calculator to forecast the value loss for a new or used ford f150. Trucks with a gvwr greater than 6000 lbs. You can avail of this deduction even if you dont have any income and there is no maximum amount.

Utilizing section 179 does not apply to those vehicles utilizing bonus depreciation. Which vehicles qualify for tax savings. Right now in 2019 its being offered at 100.

Also unlike most deductions this one does not carry a dollar based limit. The tcja now allows 1000000 deduction limit on new and used ford trucks heavy duty suvs and ford transit vans that are purchased financed or leased and placed in service between 92817 and 123122. With the 2019 you would only pay on average 80 of the price as new with 92 of the vehicles useful life remainingthe 2018 and 2017 model years are also attractive years for the f 150 and provide a relatively good value.

On the contrary you are eligible for a tax benefit amounting to 50 of the purchase price. The most important difference is both new and used equipment qualify for the section 179 deduction as long as the used equipment is new to you while bonus depreciation has only covered new equipment only until the most recent. The bonus depreciation deduction was at the 50 amount in 2017.

The vehicle must be used at least 50 for business to qualify. In 2018 it will drop to 40 and in 2019 it will drop to 30. Assets eligible for bonus depreciation now include used assets.

This can provide a huge tax break for buying new and used heavy vehicles. For assets purchased after this date the 25000 cap which applies to suvs and crossovers with a gross weight above 6000 lbs.

Section 179 Tax Deductions Get A Big Tax Deduction For Your Business Bonnell Ford In Winchester Ma

www.bonnellford.com

New Ford F 150 For Sale Lease Salt Lake City Utah Ford Dealership Near Salt Lake City

www.lhmford.com

/GettyImages-157394060-573f646d3df78c6bb0160735.jpg)