163 J Formula

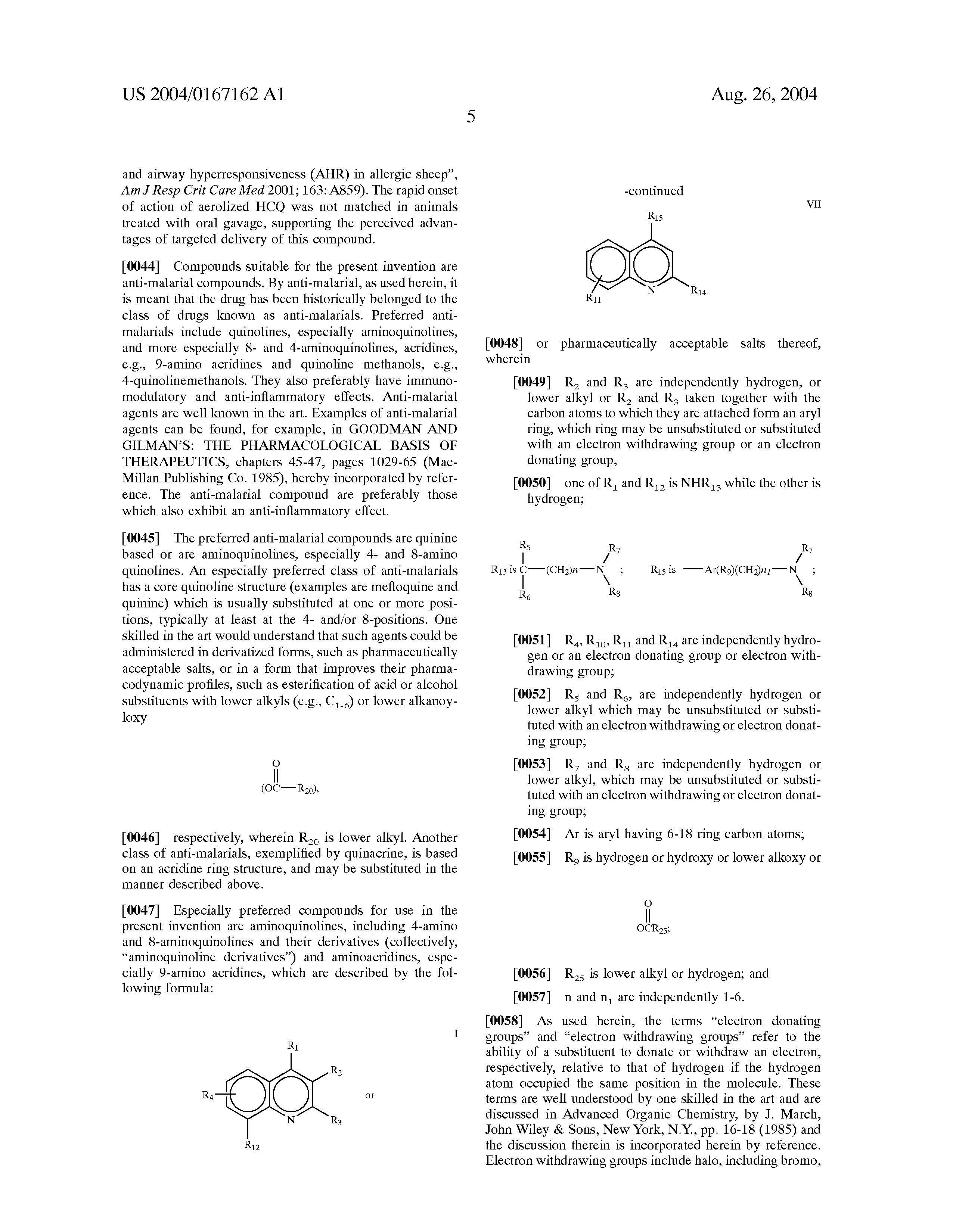

Although that deduction limitation formula may seem simple the code and the proposed regulations set out a very complex set of rules.

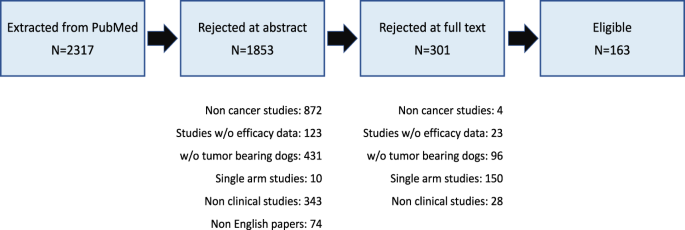

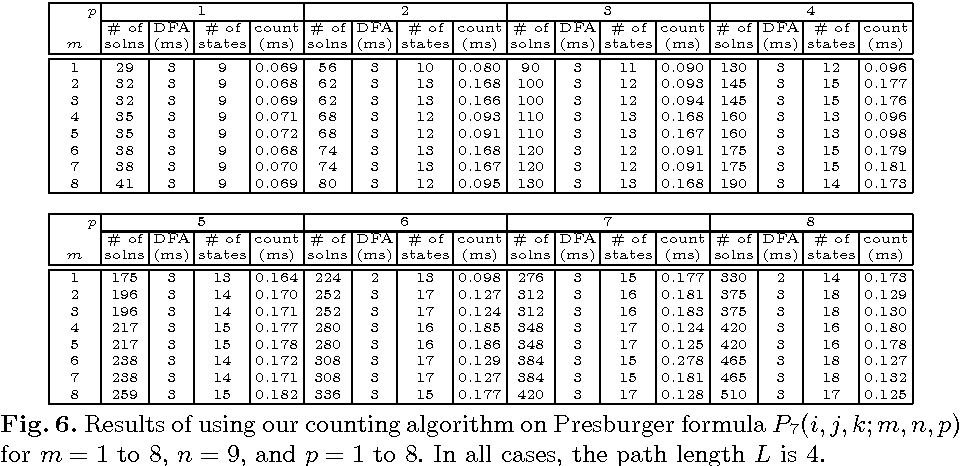

163 j formula. Companies should be aware that because the interest limitation is based on an ebitda calculation without any debt to equity ratio safe harbor a downturn in earnings will. In addition under 1163j 8 of the proposed regulations a foreign corporation that is engaged in a united states trade or business may also be subject to section 163j. 163 j from targeting earnings stripping by highly leveraged foreign owned us.

In general it limits a taxpayers interest expense deductions for a taxable year to the sum of 30. Compared with former 163j all taxpayers not just those making interest payments to tax exempt related parties must consider potential limitation under revised 163j. Softul j se adreseaza doar contribuabililor care isi genereaza fisierul xml din aplicatiile informatice proprii.

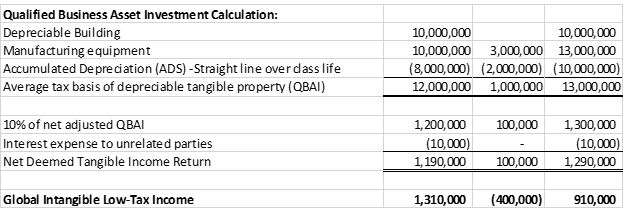

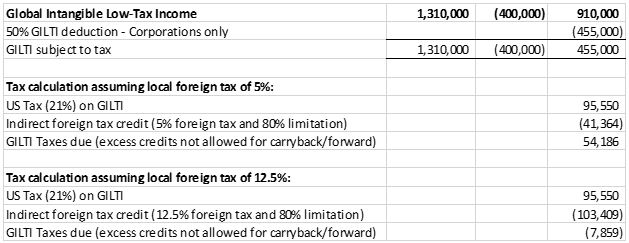

Section 1163j 7 of the proposed regulations provides rules for determining the amount of ati and calculating the limitation for cfcs. The newly enacted version of section 163 j limits deductions for business interest expense. In general section 163j limits interest deductibility for taxpayers by imposing a thirty percent general cap on net business interest computed as follows.

In the case of any demand loan or other loan without a fixed term which was outstanding on july 10 1989 interest on such loan to the extent attributable to periods before september 1 1989 shall not be treated as disqualified interest for purposes of section 163j of the internal revenue code of 1986 as added by subsection a. 115 97 fundamentally shifted the scope of the interest expense deduction limitation under sec. Section 163 j generally limits business interest deductions to the sum of 1 30 percent of a taxpayers adjusted taxable income ati plus 2 business interest income.

Section 163j limitation 4 business interest income thirty percent of ati floor plan financing interest. Broad definition of interest 5 figure 1. The 2017 tax law known as the tax cuts and jobs act tcja pl.

C corporations to broadly targeting debt utilization by business taxpayers operating in any form ie c corporations s corporations partnerships and sole proprietorships.

Ep 1450803 A4 New Uses For Anti Malarial Therapeutic Agents The Lens Free Open Patent And Scholarly Search

www.lens.org

Https Www Lw Com Thoughtleadership Irs Issues Proposed Regulations On Business Interest Deduction Limitations

A Synthesis Of Phenanthrene By Intramolecular Benzyne Cyclisation Journal Of The Chemical Society D Chemical Communications Rsc Publishing

pubs.rsc.org

Zno Nanofibers Easily Synthesized By Electrospinning A New Formula Microscopy And Microanalysis Cambridge Core

www.cambridge.org

/dotdash_Final_Accounting_Equation_Aug_2020-01-5991871f007444398dea7856b442af55.jpg)

/ScreenShot2019-01-15at3.35.40PM-5c3e475ec9e77c00019b7191.png)